Today’s pharmaceutical manufacturing facilities bear little resemblance to those of even a decade ago. More modular construction platforms are available, each with its own distinct identity and strengths. In addition, new single-use process equipment and contained process equipment and cleanrooms enable dramatic increases in flexibility and reductions in capital costs. Vaccine manufacturing facilities also have been transformed by new production platforms and better plant design.

Some biopharma facilities, especially those where single-use process equipment is being used extensively, are even starting to resemble discrete manufacturing plants.

There is a much greater emphasis on the bottom line, and reducing both capital and operating costs than there was 10-15 years ago, says Timothy McNeill, Director, Business Development Manufacturing and Life Sciences with Fluor Corp. (Irving, Texas). “Our pharma clients are much more interested in being competitive regarding cost of goods sold (COGS) and quality. Overall equipment effectiveness (OEE), equipment utilization, utility savings, HVAC, water and labor costs are being considered more closely today,” he adds.

Chris Miles, bioprocess specialist with Foster Wheeler Biokinetics (Walnut Creek, Calif.), says his clients are analyzing input and waste streams more closely, evaluating process scheduling improvement opportunities and working to better understand the advantages of incorporating single-use systems. “In each case, the goal is to use the latest technology to drive down costs at the level of the facility, the process and the components.”

Most facilities of the future are now, or will soon be, under construction in emerging markets such as China. There, the emphasis is on speed, yet there is often little understanding, at least not initially, of what the product’s final price will be. This is very different from the approach taken in the United States and Europe, explains Bikash Chatterjeee, President and CTO of Pharmatech Associates (Hayward, Calif.), which is now working on a large biosimilars facility in China for a client that plans to make its own products, and also offer contract manufacturing capacity.

“If a U.S. pharmaceutical company is going to build a manufacturing facility, they already know where they need to be in terms of final product pricing and, thus, what they can tolerate for the project. In Asia, they don’t think about that until well after the fact. Consequently, you don’t want to sink a lot of money into a facility design only to have to change it a few years down the line.”

In addition to differences between FDA, EMA, WHO, Japanese and China’s SFDA regulations, there are other uncertainties when building abroad. For instance, Chatterjee says, if you file an IND in China it takes a year or two before you get approval to move to clinical trials. The IND submission triggers an immediate inspection by the regional SFDA, which will assess your ability to support clinical activities and send recommendations to the central office in Beijing. “You have to anticipate where the concerns are going to be for that facility in the future.”

The best approach, Chatterjee says, is to consider global and local regulatory requirements carefully, and recognize that the trend is for tougher, more conservative regulations. “What you consider to be conservative today will more than likely become baseline five years from now,” says Chatterjee.

Consider the auditing of final fill-finish operations. Currently, Chatterjee says, EMA is extremely concerned about the ability of quality control professionals to audit final fill-finish operations without having to enter the area. FDA wants them to be able to audit entire operation without having to gown up and enter the area.

Regulators are concerned that if QC professionals have to gown up to enter Grade C class 10,000 areas, they might be less likely to audit them, and that, as a result, the proper degree of oversight and control won’t be there. While cameras and centralized control rooms, popular in both China and Japan, do provide some visibility into the process, they still can’t give QC the ability to intervene immediately if they see something wrong, Chatterjee explains.

“When you consider FDA’s broader requirements, and the fact they want to be able to see everything from cell banking to final fill-finish, that changes design parameters significantly,” says Chatterjee. “But that consideration needs to be there at the outset of the plant’s design.” He points to other examples, such as waste treatment for both solid and liquid plant waste. Chatterjee says the biosimilars plant in China has two halves: one, based on single-use technology, for small scale manufacturing; and the other, hard-piped, for large scale manufacturing. Both are being built in phases and are being designed to be completely autonomous as far as utilities are concerned. However, there are points where decontaminated solid waste streams do cross. “Even though one could argue that everything is contained, labeled and isolated,” he says, “regulators from MHRA commented that it would be optimal if there were no way for waste streams to cross.”

He also points to a client’s original wish to run its sterile core at a wide temperature range, to save energy and reduce costs. Without the right risk analysis, he says, one might make this change without realizing that it could require new gowning policies or a narrowing of the temperature range to ensure sterility.

“These are the little considerations that can cause you to stumble on your pre-approval inspection (PAI), says Chatterjee. Putting together a risk management framework up front that talks about the compliance, operational, design, business component, is really important.” The Chinese biosimilars plant currently has more than 40 different risk management plans for compliance alone, he says.

When a new plant will use any different or innovative technologies, it is a good idea to get FDA’s input and prequalify that equipment from the earliest stages, says Fluor’s McNeill. At Grifols blood fractionation plant in North Carolina, due on-stream by the end of next year, a staged process was used with a novel centrifugation system. FDA inspectors were invited to allow the company to prequalify the system from the start.

Modular Technologies

Modular plant construction platforms have become a requirement for more pharma plant projects. “Roughly 30% of our pharma and biopharm clients ask for modular solutions,” says Susan Stipa, Business Development Director with Foster Wheeler Biokinetics.

Vendors offer a range of technologies, from GCon’s enclosed PODS, to the more traditional stick-built systems of Modular Partners and Pharmadule. Engineering and construction (E&C) companies are partnering with all these vendors, and offering pharma clients a wider range of options, but targeting solutions closely to fit specific process needs. They also offer an “agnostic” or objective point of view, Stipa says, and can help end-users compare the pros and cons of each technology.

For all its strengths, modular construction can be expensive. Shipping costs and taxes can be very high in some parts of the world. In addition, there can be some complications in shipping. For instance, GCon just introduced new module sizes to facilitate shipping on flat-bed trucks in Europe, says Maik Jornitz, business development director.

The trick to reducing overall project costs is only to the processing and GMP-critical areas, says Fluor’s McNeill. “You want to reduce cleanroom space,” he says. “You move HVAC and controls into a central spine that is easily modularized and shippable. It’s a simple solution that lets you gain a high degree of control.”

People are looking to turnkey solutions with a central processing space, McNeill says. “That’s slightly different than fully modularized. Only 25% of the facility is actually processing space.

Using both modular technology and single-use process equipment requires thinking through process and facility needs from the start of any project. “Single-use systems force one to think of the manufacturing space in new ways,” says Foster-Wheeler’s Miles. Unit operations are typically portable, he says, and multiple configurations for different products must be considered before committing to construction.

The design and layout of single-use tubing is extremely important, and often overlooked, E&C experts say. This is true in cleanrooms, which require a large amount of hygienic piping, says McNeill. “Connecting sterile connectors is not as easy as it seems.”

“Understanding the process and equipment interactions is the key to success,” says Miles. “Having detailed conversations with the operators and equipment suppliers upfront will prove to be a valuable investment.”

In general, says McNeill, designs must be simpler and, by definition, more mobile than traditional layouts. For fluid transfer, three-fourths of the process fluid will be in tubing, driven by peristaltic pumps. These pumps are slow and can have operating issues. “Without proper planning you can end up with piping spaghetti,” he says.

Single-use systems also pose challenges in plants that are being built in developing markets, Chatterjee says. “As you move through the process chain, and to sterile environments, you have this juxtaposition of equipment capability and operator performance. Single use puts much more pressure on the operator.”

In China, he says, in regions around major urban centers, there is a large, skilled workforce familiar with bioprocessing needs. But when you move out to the more rural areas, that skilled labor pool is limited.

In addition, Chatterjee says, the larger size of some of the single-use bags poses technical and operational challenges.

“If you’re doing cell culture in a CMO-based facility, you may have two different products going through from cell packing to inoculant in parallel, with separate process streams,” he explains. “One can be in process, one can be staged. More often than not, if you’re using a single-use design at the end of the cell culture harvest function, that product can be bulked and staged for the purification process in the room, but what happens if those bags leak?” It becomes more of a question of supplier capability and risk management, he says.

In general, operator and overall workforce skills should be considered closely during initial design stages, Chatterjee says. “Do a mistake-proofing exercise when you get to the process design and marry that with risk management tool assessment. The goal is: How can we design it so we can’t fail.”

Pharmatech designed one single-use facility with different connectors, and used color coding and secondary reinforcement. Within the facility, zones were in different colors so operators had reinforcement, and it was easy for them to do the right thing.

“In any facility, you’ll always have the issue of process sequence, and that’s more difficult to engineer into the process,” Chatterjee says. “That’s what you give up when you move to single use. You can’t automate everything.”

Redefining Modular Construction

Modular systems have been a critical part of pharma and biopharma plant construction for the past 30 years. A growing number of companies, including the cleanroom specialist AES, as well as Modular Partners, KeyPlants and Pharmadule Morimatsu AB (formerly Pharmadule AB) offer expertise in modular plant construction.

Pharmadule AB was formed in March 2011 when Pharmadule’s assets were acquired by its close partner, the Japanese process equipment manufacturer Morimatsu. As Ulf Danielsson, marketing director, explains, the Japanese company is a large manufacturer with a strong presence in China, where it employs 3,000 people at its process equipment factory in Shanghai. “We can provide the building envelope around our partner’s equipment,” he says.

The company has developed a new biopharm concept facility based on traditional modular and pre-engineered solutions. “The idea is to try to make as much as possible pre-engineered. We want to manufacture as much as possible in the workshop, not in the field,” Danielsson says.

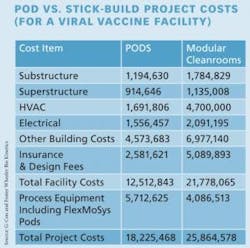

Entering the scene fairly recently is GCon Bio, which has extended the definition of modular, offering self-standing pods, each with its own HVAC and control equipment, that can be plugged into new, and even existing, facilities. The pods, now in Generation 3 of their original design, can drastically reduce the time required for commissioning and starting up a new facility (Table).

Gradalis Construction licensed the pod technologies that Shanahan and Barry Holtz had developed, to form the new company, now called GCon. Each pod is fully equipped and autonomous because it features a redundant HVAC system, and cleanroom processing system with or without gown in area, connected to a Class 8 corridor. The pods are 42-foot-long, 18-foot-wide containment systems that can float on air bearings allowing them to be disconnected and reconnected and moved around.

As Jornitz explains, the pods can maximize flexibility when equipped with single-use technology. “You can plug and play downstream and harvest processes. If you’re using one filtration system for a particular cell line, then you need to switch to a different harvest step; you can unplug the part with the filtration system and bring in a totally different part, for example, for centrifugation.

As Susan Stipa, business development director for Foster Wheeler Biokinetics, explains, the pods can be constructed while engineering is happening, cutting some project timelines from three years to 15 or even down to 12 months. Instead of building a Greenfield facility, users can install pods in moth-balled older plants or even into leased warehouses.

The technology has been installed at the NCTM at College Station and at Caliber Biotherapeutics, a GCON subsidiary that worked on the DARPA funded Blue Angel vaccine project, which received $40 million in government funding, and reduced startup time to 18 months. In addition, projects are underway in Asia, Europe and southern California, where both single-use and stainless equipment is being used as well as a large blender.

Modifications were made when the systems moved from personalized medicine to vaccine manufacturing, with the emphasis changing from straight ISO cleanroom classification to biosafety level. “The question is whether you need a pod with a positive or a negative pressure cascade,” Jornitz said. The pods are designed to prevent downstream cross-contamination, which is especially important for cytotoxic API work.

This article was published in the January 2013 issue of Pharmaceutical Manufacturing.