The case of biotechnology pioneer Genzyme highlights an undisputed fact: companies that stumble when it comes to building robust manufacturing operations pay a steep price. In 2008 when Genzyme attempted to scale up production of Myozyme, a treatment for a rare condition affecting the heart and skeletal muscles, the Food and Drug

Myozyme is a treatment for a rare condition affecting the heart and skeletal muscles.

Administration (FDA) determined the manufacturing process deviated enough from the original that a new Biologics License Application was required. This setback was followed by other manufacturing issues, and the cumulative effect of the problems triggered declines in Genzyme's stock price, opening the door for the company's acquisition by Sanofi in 2011.BETTER PROCESS, BETTER ECONOMICS

Though always a critical issue, process robustness — the ability of a manufacturing process to produce acceptable quality and performance levels despite variability in inputs such as raw materials or operator expertise — has become a mounting priority within the pharmaceutical industry. Among the reasons for the shift: cost pressures, increasing product complexity, and intensifying quality requirements from regulators. The payoff from improving process robustness is significant, with as much as $25 billion in potential savings in cost of goods sold industry-wide and a comparable boost in revenues due in large part to a reduction in product shortages. For a newly launched drug, that could amount up to about $400 million in additional cost savings and revenue upside over the product's patented life.

Turning that opportunity into reality, however, requires a new approach. Using extensive client work and detailed modeling of how various factors affect the supply chain, the Boston Consulting Group has identified supply lead-time volatility (SLTV) — the variation in the length of time it takes to produce a product, from receipt of the order through final quality release — as a key metric for tracking supply chain performance. High SLTV is often due, either in part or entirely, to low process robustness. Investigating the root causes and business impact of low supply-chain performance can help companies identify the best opportunities for improving process robustness.

A FEW TOUGH QUESTIONS

As process robustness grows in importance, operational executives should ask themselves a few tough questions:

• Is the company making adequate investments to enable the development of process robustness capabilities?

• Are discussions on process robustness occurring at the right levels of the organization, across operations, R&D, and commercial?

• Are efforts to enhance process robustness prioritized appropriately according to the overall financial impact of improvements?

• Where process robustness is low, are adequate inventory or capacity buffers (or both) in place to minimize the consequences?

Answers to those questions are crucial to driving a systematic and coordinated strategy for optimal process robustness.

PROCESS ROBUSTNESS MOVES TO THE FOREFRONT

It is no secret that the pharmaceutical industry’s process robustness trails that of other industries, including semiconductor and automobile manufacturing. This stems from three factors. First, companies must manage the tension between the need for robust process and other considerations, including the focus on speed to market due to significant commercial value being at stake and the risk of overinvestment in early-stage product development given high R&D failure rates. Second, a strict regulatory environment has made companies conservative in adopting new robustness-enhancing technology that may trigger extensive regulatory approvals. Finally, the expertise required to deliver systematic robustness improvements is scarce and management has often seen process robustness as a technology "black box," one they should leave to company engineers or Six-Sigma experts.

That mind-set, however, has shifted dramatically over the last decade. For one thing, companies are under pressure to cut costs, putting manufacturing efficiency in the spotlight. At the same time, company portfolios have grown increasingly complex, with the addition of biologics and products with novel delivery mechanisms as well as the shift in demand from developed markets to developing countries. Finally, global regulatory bodies are setting ever-more-stringent quality requirements, including a focus on "quality by design."

The industry stands to see a big boost if it responds aggressively to these pressures. We estimate that moving the industry to a 3.5 sigma level from the current estimated level of about 2.5 would yield significant cost savings — up to $25 billion annually — as less defective product is produced and the greater reliability of manufacturing allows companies to lower inventory levels. Revenues could see a similar boost as companies experience fewer product shortages. (The cost savings are split between innovative and generic drugs, whereas the bulk of the revenue boost is projected to come from innovative drugs because of their higher margins.)

THE IMPORTANCE OF MEASURING SUPPLY LEAD TIME VOLATILITY

The key to improving process robustness is understanding where opportunities lie. Traditionally, companies have tracked process robustness through measures such as batch failure rate. These metrics offer insight on the overall success rate of a manufacturing operation but do not provide insight on the variation in effort required to reach a successful batch. Consequently, SLTV can be an invaluable complement by factoring in the consistency requirements in manufacturing.

In the classic lean approach, tools such as Takt Time, standardization, and Kanban cards all put a spotlight on sources of manufacturing and supply volatility. But in the pharmaceutical industry (unlike in, for example, the auto or electronics industries), supply volatility has not been a major area of attention, with companies instead focusing on inventory and agility strategies in order to address volatility in demand. However, as pressure to reduce costs and working capital leads companies to decrease these buffers, those that do not focus on supply volatility will likely face weakening service levels.

In fact, our modeling exercise and client work reveal that the failure to address supply volatility is a major missed opportunity. We find that, as is often the case in today's pharmaceutical industry, when supply lead time is comparable to or longer than the forecast period (the period for which a company can reasonably project demand), SLTV has the same impact as or a larger impact than demand volatility on requirements for both inventory and manufacturing capacity buffers. The upshot: addressing SLTV will likely affect a company's performance similarly to or more than focusing on demand volatility.

DELIVERING REAL GAINS IN PROCESS ROBUSTNESS

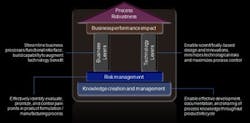

Just as important as knowing what to measure is knowing how to execute a manufacturing improvement program. That plan should encompass three key steps (Figure 1).

Figure 1: The Process Robustness Framework

Set the Knowledge Management Foundation for Process Robustness. The process development team has a keen knowledge of factors influencing the robustness. But when that process is handed off to the commercial manufacturing team, documentation of that insight is often lacking. In addition, as the commercial manufacturing team finds ways to improve a process, those lessons are rarely fed back to the process development team. It is critical to develop a means of systematically disseminating process knowledge across the organization — beyond the joint team structures or bridge organizations that typically exist to connect R&D and manufacturing.Set Priorities and Manage Risks. SLTV, in conjunction with other supply-chain metrics such as inventory level and batch failure rate, can be used to identify pain points in supply chain performance. In cases where poor process robustness is part of the problem, efforts to boost robustness can be prioritized according to the potential impact on SLTV and the company's service and financial performance.

Determine the Right Mix of Tools to Deliver Improvements. With the right areas for improvement identified, companies can deploy technology or business levers, or both, to deliver the targeted changes. Technology levers spur improvement by increasing scientific understanding of manufacturing processes, introducing innovations, and increasing standardization, whereas business levers focus on streamlining processes, clarifying responsibilities, building capabilities, and enabling continuous improvement.

Figure 2: Selected Technology and Business Levers by Product and Process Lifecycle

The mix of technology and business levers a company should deploy depends on many factors, such as the product’s life-cycle stage (Figure 2). During the early process-design phase, for example, technology tools such as modeling and simulations can be powerful aids, whereas during the commercial production phase the use of technology incubation to develop the next-generation production process may be more effective.KEY PRINCIPLES ON THE QUEST FOR PROCESS ROBUSTNESS

The pharmaceutical industry is at a tipping point, with outside pressures making it essential to push for high levels of process robustness. To succeed, companies must embrace three principles. First, they should set priorities for making improvements based on where the reward — measured in terms of things like impact on revenues and service level improvement — is greatest.

Second, they must take a life-cycle approach to process robustness, balancing speed to market with the need to create a robust process during clinical development. Managing that trade-off effectively will include weighing the impact of lost days of patent protection for a product against the potential loss of sales and increased COGS due to weak process robustness. And across all functions incentives must be created that drive everyone toward the collective goal. The process development group, for example, can be evaluated in part on the process robustness of the manufacturing operation when it is scaled up.

Finally, companies must ensure that the technology and business levers they deploy to improve process robustness are in sync. This will require coordination and joint deployment of new technology tools and business processes by technology operations and business operations teams. For companies looking to up their game in manufacturing, there are no shortcuts or quick fixes. Instead they must commit to a true transformation.