Pharma finds balance

For the 15th consecutive year, Pharma Manufacturing readers have provided insightful feedback on their careers through our annual survey. We probe our readership to share their unfiltered thoughts in order to gauge both the financial and emotional health of their pharma careers. Their responses, placed in the context of current industry happenings, help us to piece together a bigger picture of pharma.

Happy despite criticism

A 2018 Gallup Industry Ratings Poll found that 53 percent of Americans have a negative view of the pharmaceutical industry; in fact, of the 25 different business sectors in the survey, only the federal government was held in lower esteem than pharma.

Fortunately, external opinions do not appear to be swaying pharma’s internal satisfaction. According to our readers, job satisfaction in the pharmaceutical industry is actually on the rise — more than 91 percent reported their satisfaction levels within the range of “OK” to “very high,” which is better than recent previous survey years.

In some cases, results varied by respondent demographics. Gender did not seem to be a factor in happiness, however salary made a difference. The survey found that 62 percent of those making over $100,000 reported “high” to “very high” satisfaction rates, while less than 13 percent of those making $60,000 or under reported the same level of satisfaction.

When broken down by industry segments, those working for consulting companies reported the greatest amount of job satisfaction, with a dramatic 81 percent ranking their satisfaction levels from “high” to “very high.” Those working in process control/validation were the least happy (only 27 percent ranked satisfaction levels from “high” to “very high”).

Overall job satisfaction continues to rise in the U.S., but only just recently (in 2017) surpassed the 50 percent mark — so despite being in the public hot seat, the pharma industry is well above average.

What’s driving this satisfaction? According to those surveyed, various factors (see chart below) — but one respondent summed up a common sentiment with this write-in: “Working for an ethical company in a field that provides significant benefit to customers in regards to quality and length of life — satisfaction from knowing that my work has a tangible impact on people’s lives.”

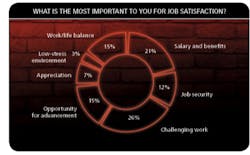

Because the definition of “satisfaction” can vary by individual, our survey asked readers which specific factor contributed most to their overall happiness. “Challenging work” was the highest-ranking factor, and has been throughout the history of the survey. This was closely followed by “salary and benefits.” This year, “work/life balance” edged out “opportunity for advancement” to take the No. 3 spot.

These results were corroborated by a write-in question that asked respondents to elaborate on what satisfies them most about their current position. Many respondents solidified their previous answer, pointing out how much they enjoy the challenge and diversity of the work they do. “Freedom and control over my projects; solving unsolved problems,” said one respondent.

Despite the long hours and stresses of the job (“There is an endless opportunity to get things done,” said one respondent, positively), numerous respondents were pleased to have flexible hours and autonomy in the workspace. Even though less than 15 percent noted “opportunity for advancement” as the most important contributor to satisfaction, many testified to their happiness with the opportunity to excel at their companies.

“There are ample opportunities for advancement. The work is quite challenging with aggressive timelines that need to be met — I look at this as a positive, “ said one respondent.

Encouragingly, many are finding fulfillment knowing their work has a direct impact on patients. They respect the commitment of their colleagues and those in the field towards this common goal.

“Being part of a team that launches products which improve treatment outcomes and overall quality of life,” said one respondent.

Also, we are happy to report that pharma still has a sense of humor, as respondents said “lunch” and “ergonomic work chairs” were also sources of job satisfaction.

What about the money?

Compensation remains strong, stable and congruent with a healthy 2018 U.S. economy as a whole. Similar to last year, just over 25 percent of those surveyed have gross annual salaries between $100,000-150,000, with the next largest group (19 percent) making $150,000-200,000 annually. And 13 percent of respondents indicated their salaries are above $200,000.

According to survey results, tenure, education and gender factor into salaries. The majority (83 percent) of those who report gross yearly salaries exceeding $100,000 have more than 10 years of experience in the industry. Just over 39 percent of the surveyed females reported gross yearly salaries exceeding $100,000, while 61 percent of men fell into this bucket.

Additionally, 62 percent of those who report salaries exceeding $100,000 have postgraduate degrees.

In this year’s survey, 66 percent of respondents reported getting raises last year, with most (71 percent) seeing an increase of 3-5 percent. Just over 12 percent of those who reported earning raises said their salaries were increased by more than 10 percent.

The 66 percent of pharma reporting increases are claiming slightly higher raises than they did in year’s survey, which is contrary to what is happening on global level. A Korn Ferry 2018 Salary Forecast predicated that, adjusted for inflation, employees around the world were expected to see lower wage increases, averaging just 1.5 percent, down from last year’s prediction of 2.3 percent.

Hard work and balance

Pharma’s healthy salaries do not come without a healthy dose of obligation. Although more respondents than in past years said they took vacation time, 53 percent of respondents still left vacation days on the table last year. This trend is on par with other U.S. industries. According to a U.S. Travel Association’s study, America’s vacation behavior is improving; but 52 percent of employees reported having unused vacation days at the end of 2017.

Although work/life balance is still low on the list of priorities for pharma, it’s growing in importance. In 2016, only 4 percent of those we surveyed pointed to “work/life balance” as the most important factor for job satisfaction; this year that number jumped to 15 percent.

This year we asked readers how many hours they worked each week — a question we haven’t asked since 2013. Not much has changed in that six years; only 12 percent of respondents are working a traditional work week (between 30-40 hours). Over 50 percent of respondents are working 41-50 hours per week, and over 32 percent are working a whopping 50+ hours per week.

Stress seems to be coming from both external or internal sources. When asked the biggest challenge they had to face in the past year, 49 percent of respondents noted “increased workloads due to organizational changes,” while 41 percent pointed to “struggles with internal management.”

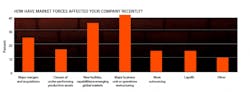

Pharma is not immune to external struggles either. When asked what current market and competitive forces affected their companies, 42 percent of respondents noted “major business unit or operations restructuring.” This answer has remained in the top spot since we started asking in 2014. This was closely followed by 36 percent who said their companies have been affected by the “launch of new facilities and capabilities in emerging global markets.”

The impact of major mergers and acquisitions continued their decline in this year’s survey, with only 25 percent of respondents noting the effects of M&A on their companies.

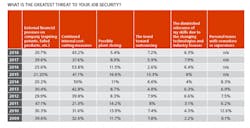

Despite obstacles, survey results reflect continued positive attitudes about job security. When asked if they were more or less concerned about job security, only 31 percent noted an increase in concern. While similar to last year’s numbers, these percentages are way down from previous years (52.5 percent in 2016 and 48 percent in 2015).

Those who were wary of job security pointed to “internal cost-cutting measures” (43 percent) as their biggest threat. “External financial pressure on my company due to expiring patents or circumstances surrounding failed product development or regulatory approval” took the second spot this year, but dropped to 21 percent from last year’s leading position of 41 percent.

Declining woes about patent expirations could have several potential explanations. According to the National Pharmaceutical Services (NPS), there were simply more potential patent expirations in 2017 than 2018. Additionally, expiring large molecule patents require biosimilar drugs — not only is their development more complex and expensive, their entry into the marketplace is heavily plagued by patent dance delays.

Tell it like it is

When given the opportunity to elaborate in an open-ended question asking what makes them least satisfied about their current position, pharma did not hold back.

Some complaints were about the industry as a whole. Many mentioned pharma’s hesitation to adapt and change in general, while others were more specific about the industry’s reticence. “Changes in technology not embraced as fast as I would wish, old analytical methods and techniques are still being used,” said one respondent.

Several voiced their concerns about pharma’s image problem and the “politics” impacting the industry. “Much of the discussion about the pharma industry being negative and driven by poor behavior of a few bad actors rather than being perceived and driven by the majority that are behaving appropriately,” said on respondent.

Internally, many are up against high workloads, high stress and long hours. Expectations are clearly lofty to the point where a handful of respondents described them as “unreasonable.”

And management does not appear to be helping. Similar to years past, management and senior leadership bore the brunt of the criticism, with respondents pointing to management’s lack of communication, lack of transparency, lack of decision making, and lack of appreciation. “The politics of senior and upper management. Never really going through the trenches, but seemingly know everything about the day to day workload each department has. They do not take the time to actually LISTEN to employees who do the ‘grunt work’ and hear how the day to day workload really is,” commented one respondent.

Some also mentioned the lack a of clear path to advancement within their companies. In fact, 46 percent of respondents said they do not receive meaningful feedback on job performance on a yearly basis.

And to the handful of respondents who said that what satisfies them least is the amount of meetings they have to attend: Preach! We feel your pain. Also, a big shout out to the person who claimed their biggest challenge was communication with our publication — our bad.

Staying on topGiven the extremely competitive pharma industry, employees can’t afford to stagnate. While respondents expressed concerns about their companies as a whole falling behind when it comes to adopting new ideas and technologies, most appear to have faith in themselves and their colleagues. One respondent said the best part of his/her position is the “quality of the talent I get to work with” — a sentiment that was echoed by numerous respondents.

And many respondents spent last year dealing with change — 21 percent said their biggest challenge this past year was “adjusting to a new role or position internally.” Despite changing circumstances, it appears that most respondents found a good fit — they are confident that their skills and training match the demands of their positions. According to survey results, 66 percent feel their skills and background are well suited to current responsibilities. Just over 20 percent admit that although they are being asked to do some tasks outside their skill set, they are generally able to execute them without specific training.

While research tells us that about 70 percent of learning on the job occurs informally, formal training, especially in a highly regulated industry such as pharma, still plays a big role. According to our survey, 54 percent say their company offers access to a formalized program of training to support business or operational excellence goals.

Survey demographics

This year’s study yielded 373 total responses. Examining demographic profiles revealed by Pharmaceutical Manufacturing’s respondents, participants were predominately North American-based (70 percent), with the remainder of respondents dispersed in Asia (8 percent), Europe (6 percent), India (4 percent), and the Middle East, Africa and Latin America.

This year, 78 percent of survey respondents were male and 22 percent female. The majority of respondents (76 percent) were 40 or older, with most possessing degrees in pharmaceutics, chemistry or chemical engineering. According to survey results, 20 percent work in quality assessment and QC, 17 percent in manufacturing and operations and 16 percent fill R&D rolls. Corporate management, academia, consulting, process control and regulatory functions were also represented.

Industry longevity dominated, with 80 percent of responding readers having seven or more years of industry experience — and an impressive 44 percent of total respondents boasting more than 20 years of pharma industry experience. Interestingly enough, despite all the grumblings about management, 67 percent are in supervisory roles themselves, with 15 percent in charge of supervising more than 15 people.

Respondents represented the true diversity of our readership, with 16 percent from Big Pharma, 16 percent from small and mid-sized specialty manufacturers, 14 percent from generic pharma, 10 percent from contract pharma and 9 percent from biopharma. The remainder, including consultants, vendor/solution providers and all others, accounted for about 35 percent of the total.