Finding Opportunity In Uncertainty: Embedding Agility in Pharma Supply Chains

Agility has become a core operational skill for pharmacos - one that will confer a significant competitive advantage. Pharmacos need to become agile so that they can respond to increasing volatility and uncertainty in global supply chains and markets. However, companies often struggle to decide where to build agility and how to make the right trade-offs between the costs and benefits of agility. Pharmacos can become agile by understanding the effects that uncertainties have on operations, building agility across functions, and including the abilities to detect and respond to volatility among their core capabilities.

THE CASE FOR AGILITY

Pharmacos have become all too familiar with the rising number of disruptions and increased uncertainty affecting supply chains. And it is not a matter of concern for the supply-chain function alone — in addition to impeding the delivery of life-saving drugs, these issues threaten the performance of the whole enterprise. Yet few companies are responding to this new reality by systematically implementing agile operations and enterprise risk management.

It’s time for pharmacos to move agility from “nice to have” to the center of the operations arena — making it a core enterprise capability that, in volatile times, will differentiate the champions from the laggards. Doing this effectively requires specific processes and capabilities for detecting uncertainty, the incorporation of agility into operations functions and processes, and strong leadership from top management.

WORRISOME TRENDS; INADEQUATE RESPONSE

In recent years, the level of uncertainty has increased throughout the global business environment. Disruptive events ranging from political uprisings to natural disasters are posing challenges to pharmacos’ increasingly global — and fragile — supply chains. Indeed, in a recent survey of manufacturing companies across industries, 80 percent of respondents said they believed the level of uncertainty is rising.

A wide range of trends can worsen the severity of uncertainty’s impact on pharmacos. Complexity in operations has increased as pharmacos have expanded their product ranges and entered new markets. Local market requirements and global production strategies have added to the management challenges. Pressure on working capital is increasing the need to finance new-drug pipelines and acquisitions. Emerging markets are increasingly important to the business, but these markets have more volatile demand and less mature distribution channels. Pharmacos are managing more generic drug launches each year that have uncertain timing and demand. Furthermore, payers have pushed to achieve cost savings through regular tenders and rebate contracts for generics.

Fortunately, pharmacos can improve their ability to respond to uncertainty. Leading companies are rising to the challenge by becoming agile. Companies with agile operations have the ability to sense, assess and respond to uncertainty—allowing them to both mitigate downside risks and capture upside opportunities in a fast, flexible and cost-effective manner.

As an example of the innovative approaches to dealing with increasing uncertainty, one pharmaco recently set up a postponement operation in a central hub in Europe with unpacked blisters ready for final language and pack-size customization. This approach enabled the pharmaco to dramatically reduce lead times and achieve up to a 50 percent reduction in safety stock, which in turn allowed it to nearly eliminate obsolete products.

Another pharmaco increased revenues and agility by implementing end-to-end supply-chain planning. The company defined three clear planning loops to ensure that each part of value chain — materials, supplies, drug-substance production and finished-product replenishment — synchronized with patient demand. It defined one owner for each planning loop and systematically challenged demand figures by flagging key changes or inconsistencies and deploying scenario planning. By setting the right planning frequency and alerts, it was able to trigger appropriate action throughout the entire supply chain. A sales and operations planning governance process facilitated management decisions on critical issues and bottlenecks. This focus on end-to-end planning led to a 5 percent increase in revenues and a 30 percent reduction of supply variability. It also put the company in a better position to respond to any sudden increases in demand.

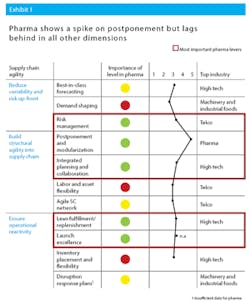

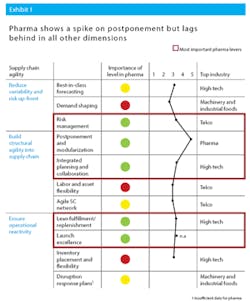

Although many companies recognize the need for agility, most say they aren’t becoming as agile as they should. Only about a quarter of the executives surveyed said that agility was a priority or an integral part of their operations agenda. And the vast majority — 85 percent — said that their company was not improving the agility of its operations enough. Indeed, in a recent assessment of supply-chain agility in dimensions such as demand shaping, integrated planning and inventory flexibility, it was found that pharmacos lagged behind other industries. (See Exhibit 1)

A THREE-STEP APPROACH

How can pharmacos succeed in increasing the agility of their operations, and where does building agility provide a payoff? We discuss a three-step approach: understanding how uncertainties translate into operational effects, building agility across all the core functions, and developing capabilities to detect and respond to uncertainty.

Step 1: Understanding how uncertainties translate into operational effects. Each pharmaco encounters hundreds of uncertainties in planning its operations. For example, a generics competitor might suddenly receive market approval, and another competitor might be forced to remove products from the same market. Identifying and preparing for each uncertainty can appear to be an expensive and potentially impossible task.

To simplify and focus agility-building efforts, it is critical to understand uncertainties in terms of the effects they have on operations. For example, the entry of new competitors or launch of promotions can each result in short-term demand variability, which can be managed with the same supply-chain tools.

Once the uncertainties have been translated into effects, companies can implement an Agile Strategy Review (ASR) process to quantify the magnitude, frequency and duration of the effects they face. During the process, an analyst prepares a clear overview of current uncertainties and quantifies the effects. The review’s output allows the company to prioritize uncertainties.

Uncertainty typically has the following seven effects on operations. For each effect, we specify the questions pharmacos should ask to determine the right actions for an agile response:

Cyclic demand: How can operations preserve margin in down cycles while capturing disproportionate volume in up cycles? This is relevant for drugs used to treat flu or any other illness that is seasonal or cyclical.

Mix shifts: How can operations be set up to increase the likelihood of developing blockbusters in a large portfolio of drugs without overinvesting in capacity for every drug? For example, can a facility make multiple products, allowing it to shift between them in response to changes in the demand mix so that it can reduce the chances of idle or underutilized capacity?

Short-term demand volatility: How can operations maintain service without compressing margins through haphazard reactions? Among other options, this might entail asking a contract organization to contribute a greater share of products to ensure an agile response to a demand surge.

Supply disruption: How can operations ensure that an external disruption to supply affects the company to a lesser extent than its peers, allowing the company to capture share as a result? The company should consider issues such as whether it could insulate itself from disruption if a common supplier for the market loses three months of capacity after failing an FDA audit.

Internal disruption: How can operations quickly react to minimize the impact on volume of an internal disruption to supply? For example, a company might have a rapid-response team that goes to a plant whenever a quality issue flares up. Their objective would be to “put out the fire” and then design a sustainable solution to address root causes.

Input-cost volatility: How can operations go beyond financial mechanisms to further insulate the supply chain from input-cost volatility? A company might launch a supplier-collaboration program in an effort to share the risk for a key API that is also used by other manufacturers. This can help to ensure preferred treatment when the API is in short supply and thereby lessen cost increases.

Safety and operational risk: How can operations increase its ability to predict equipment and process failures? Pharmacos that apply best practices in agile maintenance, for instance, would use leading indicators such as machine temperature or operating hours to reliably predict potential breakdowns.

Based on the answers to these questions, a pharmaco can better understand how its operations can manage each effect and thus the key uncertainties.

Step 2: Building agility across functions, coherently. After a company identifies and prioritizes uncertainties based on the effects, it must quickly move to embed agility in organizational areas in which it will have the greatest payoff. The company should conduct a review of regions and end-to-end product supply chains to understand where the effects of uncertainty will require the most agility to best serve customers and drive profitability. This should be followed by a review of the current state of the agility-related capabilities of its core operational functions. The company can then apply the appropriate levers to build agility in the targeted areas.

There are some areas for which agility promotes cost improvements (for example, labor flexibility both improves service and reduces overtime and idle time), thus making investments in agility a “no regret” move. Other areas will require long-term strategic investments that entail trade-offs between agility and costs. A typical trade-off entails adding redundant capacity to meet spikes in demand or cover for a failure at a facility. Another common agility investment relates to inventory placement — pharmacos can choose to store inventory closer to customers to react more quickly in case of urgent demand.

In Exhibit 2, you see the levers that companies can apply to build agility in each function and indicates which levers can have the greatest impact for pharmacos. Together, these levers constitute an “agility toolbox.”

One of these agility levers is having a true multi-echelon philosophy. Instead of managing stock levels at each loop of the supply chain separately, a multi-echelon philosophy dictates a comprehensive approach that covers suppliers for API, tablets and blister packs, as well as finished-goods inventory at internal warehouses, distributors, wholesalers, hospitals, etc.

Pharmacos can increase their agility by designing the optimal configuration for the supply chain to leverage the benefits of late-stage customization and postponement. They can substantially reduce total cost to serve, for example, by customizing to order — that is, using anonymous blisters for primary packaging, and customizing on a postponement line based on country orders. This gives the company additional flexibility to react to sudden changes in mix (for example, packaging type or volume per country) and makes it less vulnerable to obsolescence (as could happen if, for example, a packaging change rendered large quantities of packaged products obsolete, requiring expensive rework or disposal). This approach is especially attractive for products with low packaging volume per SKU, high bulk volume, high value or high demand variability.

Step 3: Make detection and response core capabilities. With key agility elements integrated into its operations, a pharmaco can shift its attention to building capabilities to detect and respond to events as they occur. As a role model, pharmacos can look to military organizations. Consider the high stakes (victory or defeat, life or death) and extraordinary level of agility required when conducting a military operation in an unfamiliar territory or a hostage-rescue mission. Although business is not war, what can pharmacos learn about agility from the military?

Pharmacos can use the following questions for a high-level assessment of their operation’s agility:

1. Understanding how uncertainties translate into operational effects

- Would each functional leader agree on the top uncertainties the company faces?

- For each of the top uncertainties, what magnitude, frequency, and duration is the company prepared for (such as the number of supplier failures or the intensity and duration of the next cyclical demand increase)?

2. Build in agility across functions, coherently

- What happens to the P&L, balance sheet, and customer service at the coverage level you’ve established?

- How do you build uncertainty into your ROI calculations?

- When uncertainty strikes, can all functions respond with equal levels of agility? To what extent can they, for example, flex capacity up and down without undue margin pressure, or shift supply, formulation, and conversion if a disruption occurs?

- Are your suppliers and logistics providers contributing to your agility, or do they slow you down?

3. Make detection and response core capabilities

- For key uncertainties, do you have a dashboard of leading indicators and clear thresholds?

- Who is responsible for identifying each type of uncertainty to the organization as they are gaining speed?

- For key uncertainties, do you have a cross-functional response team (“special forces”) and clear decision rights?

- How do you build agility in your leaders? What level of the organization gets that training?

- A regular army makes heavy investments to develop standard work processes and training given its emphasis on broad interventions in visible terrain.

- A peace-keeping force will require a wide range of talent and skills to give it the agility to fulfill its broad mandate to restore public order, safety and economic activity in an area. This includes responding to security risks, medical needs and communication requirements.

- A special-forces unit, such as the U.S. Navy SEALS, has highly targeted missions, focusing on specific target zones and a few individuals. These missions require rapid action and are often conducted under cover of darkness. A unit conducting a hostage-rescue operation, for example, would rely completely on the agility skills of its team members. They would operate with a clear mission and some level of understanding of the situation but would be expected to adapt to their surroundings. Achieving this level of agility requires the best-trained, most highly skilled people, and their deployment is reserved for only the most critical situations.

Similarly, pharmacos need to decide where they need to make the most significant investments in agility. For example, like a special-forces unit, some factories may need the highest level of agility, while others should be a basic unit that is able to execute its tasks with only modest investments in agility.

GETTING STARTED

Becoming agile has significant benefits, but a structured approach is required to capture them. Indeed, although we have seen many pharmacos begin targeted efforts to increase agility, only those that have launched holistic efforts have achieved large, sustainable gains.

Among the successful ones is a pharmaco that increased revenues by 16 percent over five years by introducing a comprehensive capacity plan to cope with volatility. The company faced shortages of a vaccine critical to public health as result of significant volatility in vaccine demand coupled with poor capacity planning. A comprehensive analysis of uncertainty gave the company greater transparency and improved decision making by allowing it to distinguish between predictable and unpredictable demand. It also built a quantitative model to clearly understand the impact of uncertainty in different scenarios. A cost-benefit analysis across a range of probability-weighted scenarios allowed the company to correct misconceptions regarding the required capacity levels. The company also identified capital and noncapital levers that would allow it to release capacity with a clear understanding of operating procedures under various demand scenarios.

To achieve such improvements, pharmacos need to follow a disciplined approach to understand uncertainties, build cross-functional agility, and implement rapid detection-and-response capabilities. How do you know if you should be investing in Agility? How agile is your company already? An agile operator would be able to provide positive answers to a series of pointed questions about its operations (see sidebar).

Organizations that don’t fare well in this high-level assessment likely have room for improvement in both managing the downside of uncertainty and capturing gains when opportunities present themselves.