It was hardly a blip in the news last month when the director of one of Russia’s leading research institutes said they could be ready to start a mass vaccination campaign against the coronavirus by fall. Plenty of other pharma companies in the hunt for a Sars-CoV-2 vaccine have stolen headlines around the world in recent months, but the work of Russian scientists combatting the pandemic has largely remained in the shadows. Now, it’s possible that’s about to change.

While the eye-popping claim that a new coronavirus vaccine could be ready for roll-out within a few months was clearly ambitious (and most likely overly optimistic), the efforts illustrate a rising aim in Russia to make a bigger mark on the global pharma scene.

Although Russia has long been a leader in other scientific fields, its pharma segment has failed to become a hotbed of technological advancements. Instead, the industry has been dominated by state-controlled policies, a high rate of imports and low-cost generic manufacturing. However, Russian leaders are now on a quest to bolster R&D investments in pharma and put the industry on track to increased independence and innovation. To achieve these goals, the industry will have to clear several major hurdles.

Government involvement

On the surface, Russian pharma patients have been given a sweet deal. Under the country’s state-controlled health care system, Russian citizens have been guaranteed access to all inpatient drugs as well as many outpatient drugs for free. Naturally, the government wants to procure these essential medicines on the cheap, which has created other challenges in the market.

For example, price caps determined by the government for essential drugs have made it difficult for local manufacturers to make money on drug production, despite prices being set to allow for 30 percent in profit (maximum). The emphasis on getting low-cost drugs has also contributed to the country’s reliance on generic medicines. And because there are not enough local producers of APIs on the domestic market, the industry is also heavily reliant on API imports for manufacturing from China and India.

So, in 2011, the Russian government launched an initiative called Pharma 2020 to lay the groundwork for more domestic pharma production. At the time, about 90 percent of the drugs on Russia’s market were imported and the goal was to reduce that figure to 50 percent. Nearly 10 years later, Russia is headed in the right direction but is still importing about 70 percent of its drugs.

Meanwhile, growth in Russia’s pharma market appears to be increasing each year, but only modestly, and the growth has been slowing. According to Oleg Berezin, a partner and the head of the Life Sciences and Healthcare group at Deloitte, the country’s pharma industry grew by 9.5 percent (in Russian ruble terms) in 2019, but after adjusting for inflation for drugs, the real growth was only about 7 percent. This year, the market is set to grow more, but mostly due to inflation and government spending.

“We don’t have double digit growth like we had five years ago,” Berezin says. “Currently the market is not just stagnating — there is small growth.”

Still, the Russia government’s use of financial instruments such as tax benefits and subsidies has helped breathe new life into the pharma market. In 2018 alone, 12 new large production sites were opened in Russia.

The cash flow has also helped buoy scientific progress in drug development. In the last few years, Russian pharma companies have introduced several new drugs onto the market including a next-generation protease inhibitor for hepatitis C developed by R-Pharm, and the world’s first approved biosimilar for dornase alfa, a cystic fibrosis treatment, made by Moscow-based Generium.

Yet, low drug prices are continuing to create roadblocks for local drugmakers. In April, a group of seven manufacturers informed Russia’s Industry and Trade Ministry that they may have to stop making about 50 essential medicines because the cost of production now exceeds the sale price, partly due to the devaluation of the ruble and rising API prices caused by COVID-19.

The next move

Now that more infrastructure has been built to produce pharmaceuticals, the Russian government is looking to take the next step and invest in long-term industry growth and globalization. Today, a new initiative called Pharma 2030 is in the works, which Berezin says will attempt to make the country’s pharma industry more competitive and innovative.

Berezin says that Russia has enough facilities for finished dosages to make most essential drugs onshore, so the focus is now on decreasing imports of APIs.

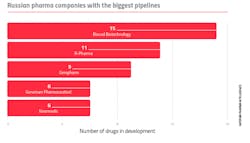

Source: Informa Pharma Intelligence

“We already have some incentives for local producers of APIs,” he says. “There are specific benefits and incentives with respect to drugs that are sold to the government and produced locally, which are even larger if a drug is produced out of local APIs.”

The bigger challenge, Berezin says, is going to be boosting the development of first-generation therapies and transforming the industry into a high-performing export-oriented sector, which is another goal of Pharma 2030.

“There is not enough financing for R&D from Russian pharma companies or Big Pharma companies, which generally don’t have R&D activity here except for clinical trials,” he says.

One mechanism that could be created by Pharma 2030 is the support of more joint ventures for pharma companies looking to enter emerging markets. A specialized venture fund could also further support pharma innovations.

The trick will be balancing Russia’s historic isolationism and emphasis on the domestic production of low-cost drugs with the desire to be competitive on a global level.

It’s also unclear to what extent the initiative will make Russia an attractive destination for investments from multinational pharma firms. Although several Big Pharma companies — such as Novartis, AstraZeneca and Sanofi — operate in Russia, the current emphasis is on producing drugs for the local market in a wide range of therapeutic areas such as oncology, diabetes and cardiology. However, Berezin says that some, especially those that do not have local manufacturing facilities, lose market share due to the preferential treatment given by Russian government contracts to local manufacturers.

The digital landscape

Modernizing the country’s pharma sector is top-of-mind for Russia’s industry. To that end, Russia has mandated new track and trace regulations that are currently scheduled to go into effect on July 1 (although the deadline could be postponed). Similar to other programs around the world, Russian pharma manufacturers will have to report every step their products take through the supply chain, as well as pricing information. Ultimately, the goal is to reduce the presence of any counterfeit drugs or other illegal practices on the market.

And Berezin says that if producers and market authorization holders have all of their drug data reported by the entire supply chain to the system, it will create a big opportunity to use and analyze this data.

In general, however, the pharma industry in Russia has been slow to adopt digital tools. Only about one-third of Russian companies who responded to a recent survey conducted by Deloitte said they have implemented a digital strategy. Although companies understand that there are advanced solutions available, many still rely on websites and social media as their only digital tools.

“In this particular area, the Russian market has a long way to go, but recent regulatory developments, such as a green light for OTC online sales, will likely boost it,” Berezin says.

The COVID-19 effect

The effort to be the first country that successfully secures a coronavirus vaccine has echoes of the old space race. Will Russia pull off another Sputnik?

Russia’s deputy prime minister for Social Policy, Labor, Health and Pension Provision, Tatyana Golikova, has stated that the country has 47 coronavirus vaccines in development, although just 10 have been recognized by the World Health Organization. Clinical trials on at least two candidates are set to begin this month, and the hope is that at least one candidate could be registered with local regulators by fall.

The country has plenty of reasons to want to rush progress. To date, Russia has the third highest number of coronavirus cases in the world, and securing a vaccine will be a crucial step for the country’s recovery.

Russia is also working on new treatments for the coronavirus, and the CEO of the Russian Direct Investment Fund made a bold claim in May that its scientists have developed “perhaps the most promising COVID-19 drug in the world.” The drug, called Avifavir, is based on an existing flu treatment that Russian researchers have enhanced. Early results from a study of 330 participants showed that it can reduce the duration of the coronavirus to just four days in some patients.

Developing a game-changing treatment or being the first country to approve a coronavirus vaccine would make a definitive statement about the capabilities of Russia’s pharma industry. As the country moves to bolster its ability to be an innovative force in pharma, its efforts to fight the coronavirus could help put Russian drugmakers on the global pharma map.

Top image courtesy of Jean Colet via Unsplash.com.