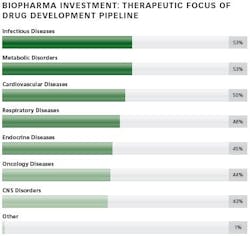

The ability of biologic drugs to treat chronic and other challenging diseases has led to a steady increase in the demand for these medicines around the world. Both investment in innovation by large and small bio/pharma companies and the number of biopharmaceutical drug approvals have also increased. Expanding pipelines have led to a significant growth in investment activity, as both sponsors and contract manufacturers seek to add production capacity designed to enable commercialization of the most advanced, complex large-molecule drugs. Many new facilities are designed for flexibility, combined with low-cost, highly efficient manufacturing.

REAL GROWTH

The biopharmaceutical market in 2015 was valued at $200 billion and growing at ~14 percent annually, according to BioPlan Associates.1 The top 15 biopharma products each have annual revenues of greater than $2 billion and some (e.g. Humira) generate sales of more than $10 billion per year.2 The clinical pipeline is robust, with 10 to 15 new biopharmaceutical therapies expected to receive approval each year, and greater numbers of biosimilars also are expected to reach the market.2

The global biopharmaceutical contract manufacturing market is, consequently, also very healthy. In June 2015, HighTech Business Decisions (HBD) predicted that the market for biopharmaceutical contract manufacturing services would reach $3 billion in 20154, while Roots Analysis estimates the market is growing at an annualized rate of 8.3 percent.5 HBD also predicted that the biopharmaceutical contract manufacturing sector will increase its capacity for mammalian cell culture production by 14 percent and for microbial fermentation production by 16 percent by the end of 2016.4

DRIVING INVESTMENTS

The strong growth in demand, combined with globalization of the biopharmaceutical industry, is driving significant investment in the expansion of existing and the addition of new capacity in many established and emerging markets. Some of this capacity belongs to international bio/pharmaceutical companies looking to establish a presence, as individual governments increasingly require in-country manufacturing of medicines and vaccines.

Indeed, according to BioPlan Associates, bioprocessing-related budgets were higher in 2015 than the year before across all areas, including capacity expansion, equipment expenditures, process design, new personnel hiring, and facility construction, although a significant portion of current investments are targeted at improving productivity through enhanced process development capabilities and the implementation of new technologies, particularly for downstream processing.1

NEW LOOK FOR FACILITIES

Constructing conventional, large-scale biopharmaceutical manufacturing facilities typically costs $200 to $500 million (vs. $30 to $100 million for similar-scale, small-molecule plants) and takes four to five years, according to McKinsey.2 It is not surprising, then, that many of the new plants under construction are being designed to take advantage of single-use systems, which are now suitable for commercial production of mAbs and other proteins given the 10+-fold increase in titers achieved today. A 2000-L disposable bioreactor can now replace a 20,000-L stainless-steel vessel, allowing for significant reduction in the necessary scale for biopharmaceutical manufacturing facilities. When compared to traditional stainless-steel equipment, single-use technologies have been shown to reduce capital and operating costs by 40-50 percent and 20-30 percent, respectively, and time-to-build by 30 percent.6

Other features and technologies being incorporated into many of the newest facilities include capabilities for continuous upstream (USP) and downstream (DSP) bioprocessing, and for the production of highly potent biologic APIs and drug products.

LOTS OF SPONSOR ACTIVITY

Investments in biologics facilities by sponsor companies cover all aspects of biologics drug development and manufacturing, including API production, fill-finish and packaging operations. In addition, not only international, big pharma/biotech firms, but also developing start-ups are making these investments. Ireland and Singapore are two hot spots for recent biopharma investment, but dollars are being spent around the globe. Many announcements have been made as recently as December 2015/early 2016.

Recent big pharma/biotech investments include:

• Expenditure of approximately $550 billion by Boehringer Ingelheim to expand its biopharmaceutical production capabilities in Vienna with the construction of a large-scale manufacturing facility for biologic APIs manufactured using cell cultures.

• Bristol-Myers Squibb is planning to build a new state-of-the-art, large-scale biologics manufacturing facility in Dublin at a cost of ~$900 million that will produce multiple therapies. The company is also expanding its recently opened $500 million biologics production site in Devens, MA.

• Novartis has broken ground on a new $500 million biologics plant in Singapore. Its generic pharmaceuticals business, Sandoz, recently inaugurated its new, nearly $165 million, state-of-the-art BioInject biopharmaceutical manufacturing facility in Austria.

• Biogen plans to invest $1 billion to triple its biologics capacity with the construction of a fourth manufacturing plant in northern Switzerland.

• AstraZeneca acquired a high-tech biologics bulk manufacturing facility in Boulder, Colorado, from Amgen in September 2015 that it is refurbishing. The site is expected to be operational in late 2017. The purchase followed announcements that AstraZeneca is investing $285 million in a biologics facility in Sweden and expanding its Frederick, Maryland, site. The new Swedish facility will focus on filling and packaging of protein therapeutics and, from 2018, supplying medicines for the clinical trial programs of AZ and its MedImmune subsidiary.

• Pfizer is spending $100 million to upgrade its biologics plant in Ireland.

Genzyme is investing $80 million at its recently approved facility in Framingham, MA, adding more downstream processing capabilities for Fabrazyme, its treatment for Fabry disease.

• Eli Lilly is completing a $450 million biologics facility in Ireland. In 2013, the company also announced nearly $1 billion in planned plant expansions for the production of its insulin products, including API and cartridge manufacturing capabilities.

• Amgen opened in August 2015 a $300 million facility including a syringe filling facility and a cold chain warehouse in Singapore. The facility uses disposable technology, continuous processing and real-time analytics, has a replicable and flexible modular design with a small footprint for reduced energy and water consumption and waste generation. It was also constructed in half the time required for a conventional plant, according to the company.

• Baxter opened its first biologics facility in Asia in 2014. The $370 million facility in Singapore produces ADVATE and will also manufacture treatments for hemophilia B once a second expansion suite opens in 2017.

• Roche announced in 2013 that it is investing $880 million in biologics manufacturing capabilities, including an ADC manufacturing plant in Switzerland and expansion/upgrades of sites in California and Germany. Its Japan-based subsidiary Chugai Pharma is also investing $310 million in antibody production capacity at a plant in Tokyo. An additional $125M investment in an expansion of a Genentech fill/finish facility in Oregon was announced in March 2015.

Smaller biotech firms have not been idle, either:

• Regeneron will be investing an additional $350 million on top of its initial $300 million investment to create a pharmaceutical plant at a former Dell computer manufacturing site in Ireland.

• Alexion Pharmaceuticals plans to construct the company’s first biologics manufacturing facility outside of the United States. The nearly $500 million investment in Ireland will take four years to complete.

• Allergan is spending $350 million on a new biologics facility in Ireland to expand its manufacturing capacity for Botox and develop a manufacturing base for the next generation of biologic products currently in the Allergan pipeline.

• Jazz Pharmaceuticals is constructing its first plant in Ireland at a cost of $68 million.

• Grifols is investing $85 million in a purification plant for protein albumin at its biologics plant at Grange Castle, Dublin, earlier than planned in order to meet growing demand.

• ShangPharma plans to establish a subsidiary in the Qidong Biopharma Industrial Zone as part of a multistage expansion project for its biologics service portfolio, with $60 million invested in the first phase to build pre-clinical research and biologics manufacturing facilities. The latter should be operational in 2018.

CONTRACT BIOPHARMA MANUFACTURERS SPENDING, TOO

With the high level of in-house investments being made by sponsor companies, it might at first glance be surprising that biopharmaceutical contract manufacturers have also been expanding their capacities. Notably, most of these investments are being made by larger contract development and manufacturing organizations (CDMOs) offering full support to biologic drug manufacturers from discovery to commercial manufacture.

Many of these firms are leaders in the industry and are investing now in order to meet anticipated increased demand for their services. Others are focused on offering contract development and manufacturing services for advanced and next-generation technologies that require highly specialized capabilities, and in some cases the development of new technologies and processes to enable commercialization (such as for cell and gene therapies).

Recent and ongoing biopharmaceutical CDMO investments include:

• Samsung Biologics is investing $740 million in a new biologics manufacturing facility that will double its production capacity. The plant is located in South Korea and expected to be onstream in 2018.

• Brammer Bio, which was formed in late March 2016 when Brammer Biopharmaceuticals merged with Florida Biologix to create a cell and gene therapy biologics CDMO, now has 45,000 ft2 of process development and phase I/II clinical manufacturing space in Alachua, FL, and is developing a 50,000 ft2 facility in Lexington, MA, with plans to build-out large-scale, phase III/commercial-ready viral vector manufacturing suites and segregated cell and gene therapy suites for clinical and commercial launch services.

• WuXi PharmaTech is constructing its third cGMP facility for the manufacture of cell therapy products. When operational in mid-2016, the Philadelphia plant will produce cell therapies that contain viral vectors, such as chimeric antigen receptor T cell (CAR T cell) therapies. The second facility for autologous cell-based therapeutics was completed in 2015. The company is also building a state-of-the-art integrated biologics solution center at its headquarters in Shanghai to support biologics discovery, development and clinical manufacturing.

• Catalent Pharma Solutions opened its new, state-of-the-art biomanufacturing Center of Excellence in Madison, WI, in April 2013.

• Abbvie is investing $320 million to build a facility in Singapore for the production of both small-molecule and biologic APIs. The company will also spend $30 million to expand its Barceloneta, Puerto Rico, site.

• Patheon Biologics is adding capacity at its sites in the U.S. and the Netherlands.

• KBI Biopharma is expanding its mammalian and microbial API production capacity.

• Fujifilm Diosynth Biotechnologies acquired Kalon Biotherapeutics in 2014 and has since made additional investments to increase its bioreactor capacity and expand its process and analytical development capabilities, which are coming online in 2016.

To learn more about Nice Insight contact Andrew at [email protected] or visit www.niceinsight.com and the annual study websites: clinical services at www.niceinsightcro.com, contract development and manufacturing atwww.niceinsightcdmo.com, pharmaceutical excipients suppliers at www. niceinsightexcipients.com and pharmaceutical equipment (products, systems and services) at www.niceinsightpharmaequipment.com.

REFERENCES

1. BioPlan Associates Inc. “Top 15 Trends in Biopharmaceutical Manufacturing,” Contract Pharma, Sept. 11, 2015.

2. Otto, R., Santagostino, A., and Schrader, U. “Rapid growth in biopharma: Challenges and opportunities,” December 2014. http://www.mckinsey.com/industries/pharmaceuticals-and-medical-products/our-insights/rapid-growth-in-biopharma.

3. That’s Nice. The 2016 Nice Insight Contract Development & Manufacturing Survey, January 2016.

4. W. Downey, “Biopharmaceutical Contract Manufacturing Capacity Expansions”, Contract Pharma, June 2, 2015. http://www.contractpharma.com/issues/2015-06-01/view_features/biopharmaceutical-contract-manufacturing-capacity-expansions

5. Roots Analysis, “Biopharmaceutical Contract Manufacturing Market, 2015 - 2025”, Press Release, May 5, 2015; http://www.rootsanalysis.com/reports/view_document/biopharmaceutical-contract-manufacturing-market-2015-2025/92.html

6. R. Hernandez, “Top Trends in Biopharmaceutical Manufacturing: 2015,” Pharmaceutical Technology, Volume 39, Issue 6, Jun 02, 2015

7. N. Khan, GE Ships Ready-Made Drug Factories From Berlin to Beijing, Bloomberg, November 1 2015. http://www.bloomberg.com/news/articles/2015-11-01/ge-ships-ready-made-drug-factories-from-berlin-to-beijing.