In today’s biopharmaceutical manufacturing environment, quality management is becoming a more critical area for avoiding production problems, capacity bottlenecks and failures, particularly as regulators are increasingly expecting product applications to include extensive studies regarding optimization of product. In our newly released 10th Annual Report and Survey of Biopharmaceutical Manufacturers, where we surveyed 238 biomanufacturers, we measured the critical quality-related issues in biomanufacturing today, including process analytical technology (PAT) adoption.

PAT is defined by U.S. Food and Drug Administration (FDA) as “a system for designing, analyzing and controlling manufacturing through timely measurements (i.e., during processing) of critical quality and performance attributes of raw and in-process materials and processes with the goal of ensuring final product quality.” In many ways PAT is nothing new and involves no new specific requirements beyond those needed to support cGMP approval. The difference is that with PAT, cGMP compliance is approached in a more systematic fashion, generally including more data collected and analyzed before, during and also (the more novel aspect) after process validation. The goal is to gain better understanding and control of the process. Adoption of PAT is also voluntary and ongoing, including after processes are initially designed and approved.

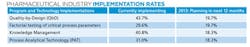

So to what extent has the industry adopted this voluntary program? In this 10th year of our study, we found about one-third (31%) of the industry has implemented PAT or elements of PAT. While adoption is still relatively nascent, a number of respondents are planning to implement PAT in the next 12 months. This year, 18.3% said they plan to do so, a number that’s below planned levels from prior years, but a significant proportion nonetheless. Presuming that respondents follow through on their reported implementation plans, about half of the industry will have adopted PAT by the end of this year. (Quality by Design (QbD) initiatives will be more common, nearing two-thirds adoption.)

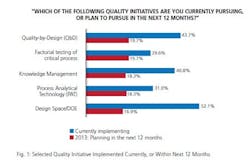

How does that measure up against other quality initiatives, of which there are many? It’s clearly on the lower end of the scale, an initiative that is still in its relative infancy. For example, the leading quality initiative currently being implemented is risk analysis/FMEA, cited by 70.4% of respondents. Behind that, a majority is also implementing risk management/analysis, platform manufacturing process and design space/DOE.

Implementation of PAT also lags other initiatives such as lean Six Sigma, knowledge management, process modeling and multivariate data analysis. But given a strong number of facilities planning to use PAT in the next 12 months, adoption should draw level with those lesser-adopted initiatives in the short term. And it’s also worth noting that it’s already ahead of a couple of initiatives: factorial testing of critical process and stage gate and in-line product reviews (26.8%).

Once these programs are adopted by major commercial manufacturers, they can be concluded to essentially be adopted industry-wide. This adoption is likely to pay off in coming years, with most quality initiatives cited involving efforts to avoid bioprocessing and product quality problems (rather than dealing with them after-the-fact). In this respect, the industry adoption of various quality initiatives shows both its maturity and the result of continued efforts to hold down costs and increase productivity.

WHAT’S CURRENTLY HOLDING BACK ADOPTION?

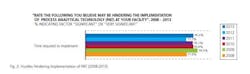

This year, we queried respondents regarding the most significant hurdles in implementing PAT, finding that for the most part, more are seeing challenges than last year.

As in prior years, the key factor continues to be, “Time required to implement,” cited by 76.5% of respondents this year as a chief barrier, up from 71.7% last year, but relatively flat from 76.1% in 2011 and 76.4% in 2010. This year, worries over cost appear to have rebounded slightly, reaching 58.3% of respondents. Budget concerns have hovered in the ~55-58% range for a few years now, after a peak of 76.2% in 2009. This suggests that budget concerns persist, but take a backseat to more pressing issues such as time constraints.

Aside from time and cost, staff constraints continue to be a major issue. This year, slightly more than two-thirds of our respondents indicated that “insufficient people in-house to manage implementation” detracted from their implementation of PAT. That’s up from last year. It appears to be widely recognized that implementation of PAT often requires one or more PAT-dedicated professional staff and/or specialized analytical and statistical skills.

There appears to be a slightly diminished concern about how regulators will deal with the information generated by PAT this year, down again this year, to fewer than half of respondents. But while respondents are less concerned with how regulators will deal with this information, they’re seeing more risk this year of regulatory issues due to small infractions or excursions as a result of implementing PAT.

As our study data demonstrates, the industry’s primary perceived difficulties in implementing PAT involve allocating the time and staff to perform this task. But there may be other factors in play as well: Lack of understanding, familiarity and associated fear may also be holding back industry-wide adoption of PAT. Among PAT’s primary goals are spotting and defining actual and potential bioprocessing problems, including those mined from bioprocessing data throughout a product’s history, not just during its process development and scale-up. This can include finding real or perceived problems where none had been known before and/or finding problems that would otherwise likely never be identified and defined, potentially with bioprocesses that otherwise had no identified problem aspects, including producing fully approvable products.

Many executives and decision-makers may fear that PAT’s forensic-type, in-depth study of otherwise perfectly functional and regulatory-acceptable bioprocessing may result in excessively high expectations for process consistency, thereby generating requirements for costly fixes, process redesign and supplemental approvals for process changes, among others. With many or most commercial products currently manufactured without PAT, it is understandable that company executives may be nervous about adopting new quality technologies and processes that they perceive as potentially discovering problems needing resolution that would likely otherwise never have been noticed.

HIRING STAFF HINDERs IMPLEMENTATION

Another potential challenge is qualified staff. This year, at least one-quarter of respondents said that quality assurance (27.8%) and validation (25%) were among the job positions at their facility they were finding it most difficult to fill. In fact, of 22 hiring areas we identified, they were the 3rd and 4th most common areas cited. The increased difficulties in hiring within quality assurance and validation departments likely reflect a greater amount of attention being paid to hiring highly qualified employees, and the experience required increasing, as quality assurance and validation become more complex and quantitatively-based, through PAT and QbD.

Other factors our study identified as obstacles to implementation of PAT over the past years involves the lack of suitable, real-time assays and other technologies required for cost-effective implementation. Comments from this year’s respondents as well as from prior years have included:

• Availability of suitable assays for PAT

• Lack of available technologies; real time analysis technologies needed

• No regulatory relief for significant PAT/QbD efforts, cost

• Lack of PAT assays to characterize vaccines

• Internal disagreement on value of PAT, especially spectroscopy

• Lack of PAT technology for biologics

• Providing more data results in questions from regulators

EXPECT ADOPTION OF PAT TO INCREASE

Given that PAT is voluntary and has that laundry list of challenges, it’s easy to see why the majority of the industry has not yet formally adopted it for their manufacturing processes. And in line with the low rate for retrospective application of PAT, it makes sense to primarily apply PAT to new processes, with it being very difficult, regulatory-wise, to redesign and modify biopharmaceutical manufacturing once a process has been adopted (and after it has been approved by FDA, e.g., used through an approved IND for clinical supplies manufacture).

Despite that, we expect to see continued increases in PAT adoption over time. Continued improvements in sensors, probes and analytical equipment are facilitating process quantification and PAT. As bioprocessing becomes increasingly monitored by improved chemical, physical and microbiological detection methods and assays, including single-use sensors/probes, the resulting data will increasingly support mathematical modeling and risk analysis. Besides this technological progress promoting increased use of PAT, industry adoption will also likely increase as PAT is recognized as an effective method for increasing productivity, reducing waste, improving yields, increasing automation and facilitating other cost-saving measures. In other words, implementation will pick up once it is widely accepted that PAT saves money in the long-term.

Survey Methodology:

The 2013 Tenth Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production yields a composite view and trend analysis from 238 responsible individuals at biopharmaceutical manufacturers and CMOs in 30 countries. The methodology also included 158 direct suppliers of materials, services and equipment to this industry. This year’s study covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment.

Published in the October 2013 edition of Pharmaceutical Manufacturing magazine

ABOUT THE AUTHOR

Eric S. Langer is president and managing partner at BioPlan Associates Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD, in 1989. He is editor of numerous studies, including “Biopharmaceutical Technology in China,” “Advances in Large-scale Biopharmaceutical Manufacturing,” and many other industry reports. Contact information: [email protected]; 301-921-5979; www.bioplanassociates.com.