Continuous manufacturing has generated buzz in the pharma industry for years. Some large pharmaceutical manufacturers have even piloted continuous manufacturing (CM) under the U.S. Food and Drug Administration’s Emerging Technology Program (ETP).

But beyond the small number of companies testing the waters on CM, the industry has yet to fully embrace this advanced technology as a replacement for the tried-and-true decades-old batch processing of pharmaceutical products. Aside from the regulatory risks of implementing and validating a new process in a pharma facility, companies may also be squeamish about making large investments in technologies that have yet to prove their worth across the industry. CM sounds good in theory — but is it really the best bet for a company’s bottom line?

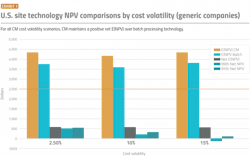

This year, I spearheaded a research effort at the University of Maryland’s Robert H. Smith School of Business to answer that question. Using a simulation-type of analysis comparing the net present value (NPV) of investing in CM versus batch technology in the U.S. or abroad, the study gathered hard data to determine whether or not CM provides more economic benefits over batch for oral solid dose (OSD) products made in new facilities.

The conclusion? CM appears to win handily over batch processing in the U.S. and even provides an economic advantage over batch processing abroad. This analysis suggests that domestic manufacturing may well be worth a closer look, and the use of advanced manufacturing technologies such as CM could pave the way to reshaping pharmaceutical supply chains and reducing product shortages and recalls.

What’s at stake

Factors at play in determining whether to manufacture pharmaceutical products in the U.S. or abroad include corporate taxes, differential labor and manufacturing costs, regulatory and environmental costs, and foreign exchange hedging expenses. Differential costs of production have been widely referenced as a primary reason for the loss of U.S. manufacturing over the last several decades.

The ascendancy of China as a major manufacturing hub over the years was accomplished in large measure by much lower labor, land and capital costs as well as more relaxed environmental regulations than in the U.S. Recent studies, however, indicate that wage and cost pressures over time have reduced the China cost advantage to a slim 4% lower cost of manufacturing compared to the U.S.

Deciding whether to adopt a new technology comes with a number of financial and non-financial considerations, trade-offs and uncertainties. And any switch to a new technology comes with both cost and regulatory uncertainty.

Batch processing has a well-established track record in the industry, which reduces both capital and operating cost uncertainty in any investment analysis. Although CM technology has been in place for decades in other industries such as commodity chemicals and food processing, there has been limited experience with it in the pharma industry. As a result, significant uncertainty over the all-in lifetime costs of this technology for specific applications, products and manufacturing scale remains.

Batch vs CM in theory

The use of advanced manufacturing technologies could help reduce regulatory risk for pharma companies. Under a standard batch manufacturing process, hold times, additional touch points and off-line testing before moving to the next step can extend overall processing time, and this can adversely affect intermediate substances such as powder segregation or lead to increased risk of contamination.

Conversely, a CM process is more automated and thus less susceptible to these potential batch processing issues. Pharmaceutical products already in place using batch manufacturing processes would require regulatory validation by the company if they were to replace the batch process with a new process such as CM. While regulatory uncertainties may be a factor that reduces interest in developing CM capabilities, the FDA has signaled its strong interest and support to the industry in adopting advanced manufacturing technologies.

One of the touted advantages of CM over batch processing is the more seamless and efficient processing of inputs and materials that can reduce manual touchpoints during production runs as well as reduce processing time, upfront investment costs due to smaller facility and land requirements, and operating costs over time. There is also the potential for greater flexibility to adjust batch size as well.

How the study was designed

To assess the economics of investing in a new batch versus CM OSD manufacturing facility in the U.S. or abroad, I conducted a simulation of the net present value over a 20-year investment horizon of batch and CM technology options for brand- and generic-focused companies. Engineering cost estimates from a seminal cost study comparing batch and CM technology used in producing 2,000 tons of tablets per year were used in the analysis along with other actual industry information on revenues and non-manufacturing costs.

The significance of this analysis is that it represents the first comprehensive investment study of pharmaceutical industry manufacturing investment choices in the U.S. and abroad as well as between current and CM technology.

In order to capture the uncertainty of costs related to CM, several scenarios were included that applied different cost factors to the CM capital and operating cost estimates used in the study. In addition, differences in brand and generic company revenues reflected actual industry historical data where brand companies in aggregate show higher and more stable profit margins compared to generic companies. Further, over the 20-year project time horizon, it was assumed based on other studies that the loss of exclusivity for brand drugs ended at year 12. Other considerations in the analysis included differences in the country manufacturing productivity and corporate tax rates, and hedging costs for foreign-made products.

The study investigated several investment strategies for brand and generic companies:

- One strategy was whether investing in CM produced higher NPV than batch processing in the U.S.

- A second strategy examined whether investing in batch processing facilities in the U.S. generated higher NPVs than investing in batch processing facilities in China, India or Ireland.

- Lastly, a set of scenarios were generated to compare investment in CM-based U.S. facilities to batch processing operations in those other countries.

A total of 156 different combinations of country, company type (i.e., brand or generic), costs and profit margin volatility assumptions were examined.

Rather than rely on a single NPV result for each of these scenarios, 10,000 different NPVs were simulated to permit evaluation of a wide range of investment outcomes.

What the analysis found

An investment in CM pays off: When looking at investments in either CM or batch for a new U.S. facility, the results showed that the lower costs of CM led to higher NPV for both brand and generic companies over investing in batch technology — even when taking into account the greater cost uncertainty of CM.

For brand and generic companies, the incremental contribution of CM over batch to the project’s lifetime expected net present value ranges between $490-$560 million, and $550-$590 million, respectively, assuming the current corporate tax rates of 21%.

The tax environment affects domestic manufacturing: Under current U.S. tax rates, investing in batch or CM in the U.S. resulted in higher NPVs than investing in batch in China or India. For example, for brand companies investing in U.S.-based CM facilities, the additional NPV benefit over investing in batch technology in China ranges between $780-$990 million. In the case of Ireland, however, their significantly lower corporate tax rate of 12.5% contributed to a higher after-tax NPV of investment in batch facilities over batch or CM facilities in the U.S.

Further, when U.S. tax rates were raised to 28%, investing in U.S. batch facilities was no longer viable compared to investing in batch facilities in China and it reduced the attractiveness of investing in U.S. CM-based facilities compared to batch processing in China or India.

The bottom line

While the results strongly suggest that investment in U.S. manufacturing of OSD is financially viable, the industry has mostly been reluctant to make investments in CM.

Several factors explain the industry’s limited investment in advanced manufacturing in the U.S.: cost and regulatory uncertainty associated with new technologies and deeply entrenched supply chains are high on the list. The pandemic underscored the tenuous nature of global supply chains and the dependency of pharma on this complex system. While reconfiguring supply chains will take time and expense, the financial viability of domestic manufacturing leveraging CM technology may make this an important strategic initiative for pharmaceutical manufacturing going forward.

This project was supported by the FDA and HHS as part of a financial assistance award [U01FD005946] totaling $285,000 with 100% funded by FDA/HHS. The contents are those of the author(s) and do not necessarily represent the official views of, nor an endorsement, by FDA/HHS, or the U.S. government.