[sidebar id=1]If, by any chance someone out there is still not clear on the concept, the pharmaceutical industry is a manufacturing industry. At the end of the day, the most successful of Pharma’s many players have to do two things really well to be competitive and remain commercially relevant: R&D and manufacturing. Those leading mid-cap biopharmaceutical companies know it to be especially true lately, as do most other players across the Pharma universe striving to go to market in current times with their medicines and therapeutic products.

Making drugs has traditionally been a capital-intensive endeavor, requiring highly specialized, highly regulated manufacturing and processing assets to get the job done. Pharma’s leaders continue to pursue market and financial success through a strategy of careful capital expenditure (CapEx) investment and attention to operational excellence, in an effort to shake the most out of their manufacturing assets.

According to PharmSource analyst Jim Miller, capital expenditure in new plant and equipment by the bio/pharmaceutical industry increased sharply in 2014. “Total spend exceeded $21.4 billion, a 13 percent increase over 2013,” Miller says, “and more than the 11 percent annual increase observed from 2010 through 2013.” Pretty impressive if one agrees capital spending trends reflect the financial health of a given industry.

BIO PHARMA ASCENDENTAccelerating CapEx spending is being fueled by the Bio Pharma sector. According to Miller, investment in captive manufacturing capacity by bio/pharma companies is an indicator of the industry’s intentions with respect to outsourcing. “Based on recent capital expenditure trends, it’s clear that bio/pharma companies would rather “make than buy.”According to the PharmSource Trend Report, “Bio/Pharma CapEx Trends: Sponsor Spending on In-House Capacity Trounces Outsourcing,” bio/pharma companies invested $118 billion in facilities and equipment during the 2010-2013 period, an amount at least 10 times greater than what CMOs have invested in themselves. Global and generic bio/pharma companies, in particular, have invested heavily in new capacity, especially for biopharmaceuticals and in emerging markets.

Miller says spending by the 25 largest global biopharma companies increased by 10.5 percent to $19.2 billion, while CapEx by the mid-size sector rose 46 percent to $2.2 billion in 2014. “It’s especially notable,” comments Miller, “that a number of mid-size companies that had enthusiastically championed outsourcing are now building captive manufacturing capacity. For instance, Gilead, Alexion, Regeneron and Allergan more than doubled their capital expenditures in the past year, and Regeneron intends to hike spending to $650 million in 2015, up from $333 million in 2014.”

ARC Advisory Group explains a company incurs CapEx — the capital utilized to buy fixed assets or to add to the value of existing fixed assets — to acquire or upgrade physical assets on plant and machinery, land and buildings, property. Most sources agree it is often used to undertake new projects or investments, and these outlays are used to maintain or increase the scope of operations. These expenditures can include everything from energy efficiency retrofits to a building, purchasing new equipment and upgrading or replacing old equipment, adding entirely new processing lines for a new product or building an entirely new factory to meet global or regional demand.

PURCHASING TO MEET DRAMATIC CHANGE

Most all acknowledge that there have been dramatic changes in the pharmaceutical and biopharmaceutical manufacturing landscape over the past decade. Guy Tiene, director of Strategic Research at Nice Insight, notes these changes “have reshaped manufacturers’ equipment and technology needs and purchasing patterns.” The leading trends driving the transformation, he says, include the changing pharmaceutical pipeline, the shift to overseas manufacturing sites, new regulatory guidelines calling for use of the latest technologies to improve quality and efficiency, and a significant increase in outsourcing. Together, says Tiene, these trends have had a significant impact on equipment and technology acquisition strategies.

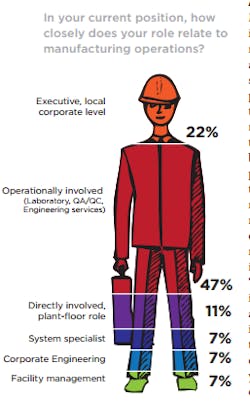

What are purchasing and operations managers seeking when determining the necessity and opportunity to replace equipment and which equipment is optimal for their needs? Nice Insight conducted a global survey of 560 purchasing decision-makers from various types of buying groups in the pharmaceutical and biotech industries in North America (47 percent), Europe (25 percent) and Asia (28 percent) in an effort to better understand what is driving equipment purchases in Pharma.

According to Nice Insight’s study, equipment quality and performance are the leading considerations by pharmaceutical manufacturers when making purchasing decisions, as companies seek products that will outperform others in quantity or efficiency. Interestingly, price ranks far lower in priority, following durability and reliability to ensure the equipment is dependable, and regulatory compliance at all stages of manufacturing with validation support that establishes evidence to demonstrate compliance. Customer service and products offering a comprehensive service agreement are of lesser importance.

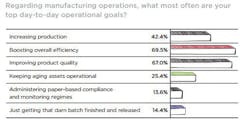

Tiene, as do others, cite the changing nature of drug development, the accelerating growth rate of specialty drugs, biopharmaceuticals and biosimilars and the increasing use of generics, are driving the demand for new equipment and technologies. Sophisticated new therapies, says Tiene, have impacted equipment purchasing considerations: “Continuous production, advanced technology and flexibility through automation and single-use technologies are in high demand for manufacturing, processing and packaging. Companies also seek equipment that can manufacture and package these increasingly complex drug products with short start-up times and easy changeovers.” Operations leadership is seeking easy-to-use, highly efficient processing equipment that will deliver value from development to commercial scale production. Regardless of whether or not a company decides to make repairs to existing equipment or to purchase new or “experienced” systems, says Tiene, “manufacturers need a reliable process that produces a quality product on a regular basis.”

READERS: SPENDING AGENDAS MIRROR TRENDS, PRIORITIES

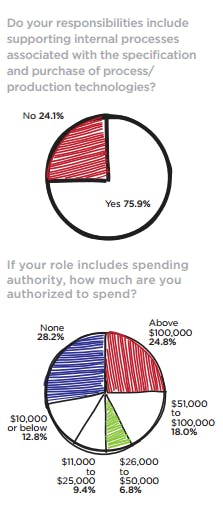

Again this year, there is no doubt that the readers who selflessly responded to Pharmaceutical Manufacturing’s (PhM) annual Facilities & Operation Investment Study represent the operations and operations leadership at the pharmaceutical companies they work for. Our annual audience polls consistently find that approximately 90 percent of the publication’s readers make final supplier decisions and contribute to the specifying of processing and manufacturing equipment. Earlier this year, the PhM editorial team queried its readers for the second time in an effort to understand more clearly how CapEx is being managed where they work and the spending priorities that support their operational strategies.

ATTITUDE IS EVERYTHING

Most pharmaceutical manufacturing takes place in the context of relatively large organizations with a range of inherent complexities associated with the development and production of drugs. It’s fair to say if the organization’s head is not in the right place it becomes more difficult to harmonize operations and meet business goals. “How important is process innovation or improvement to your organization?” To nearly all responding (96.5 percent) improvement and innovation is “important” or “very important.” However, two respondents chose “somewhat” important and another two chose “far down the priority list” indicating some organizations could use an attitude adjustment. Did anyone indicate improvement and innovation was not important? Nope, not one; everyone seems to understand you have to want it everyday if operational excellence is your goal.

It’s likely that when overall operations are not being attended to properly, meeting day-to-day as well as long-term operational objectives can be tough to reach. When asked “Given your current facility/operational profile, how would you generally characterize your production assets and manufacturing systems?” reader’s assessments of their operations were relatively sunny, with 45.7 percent indicating that operations were “Current, up to date, meeting global productivity and quality standards,” and another 44 percent selecting “Dated, but well maintained and cost-effective to operate,” to characterize the upkeep of production assets and manufacturing systems. Likely rest chose the third response “End of their lifecycle and increasingly costly to maintain,” with a sigh, perhaps lamenting the Sisyphean task of keeping everything on/in aging assets running smoothly. For our respondents at least, the capacity under their watch is being kept in good order, though there are those out there dealing with the consequences of delayed or diverted CapEx investment.

CAPEX INVESTMENT PERFORMANCE

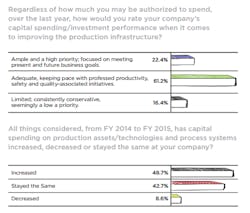

Regardless of their spending authority, we asked readers: “Over the last year, how would you rate your company’s capital spending/investment performance when it comes to improving the production infrastructure?” For a (perhaps) lucky 22.4 percent CapEx spending was “Ample and a high priority; focused on meeting present and future business goals.” Which is excellent, but the vast majority, 61.2 percent found spending “Adequate, keeping pace with professed productivity, safety and quality-associated initiatives.” Well, okay, but be glad you’re not one of the 19 who gloomily agree that CapEx spending at their organizations is “Limited; consistently conservative, seemingly a low a priority.”

Fewer (respondents) seem to be working at organizations requiring investment in informatics and data managing technologies. Just 14.8 percent chose “Production-related informatics and process data acquisition and handling platforms.” Lest we judge too harshly, these folks may be working for companies that already invested in IT and their responses indicate such spending is no longer a priority. Lastly, just under 14 percent said investment priority was directed toward “One-for-one system replacements (replace tableting press with same make, model) and component for component repair/replace routines,” which mostly suggests this is an operational spending reality in some shops and that those organizations may not be innovating or exploring new ways to enhance operations in a strategic, deliberate way.

TO CAPEX OR NOT TO CAPEX, OPEX IS THE QUESTION“Industry trends,” asked PhM, “reveal that to better manage the costs and expenses associated with drug manufacturing operations, managers are looking for innovative ways to shift from traditional capital expenditure models and turning to operational expense models in pursuit of operational improvements and new or extra capacity. Do you agree that this is a strategy worth pursuing?” Two thirds (63.8 percent) said yes, it is a strategy worth pursuing. For those who answered in the affirmative, PhM asked, “Where are manufacturing related operating expense dollars being applied?” and asked them to please pick all that apply. “Information Technology systems and infrastructure (Outsourced IT providers), was the first most popular choice (41.7 percent), followed by “Turnkey production capacity from CMOs” (40.3 percent) and “Late-stage development production” (36.1 percent). On the bottom was “Resident service suppliers and administration (i.e., sterilization services, QMS administration, etc.)” with 22.2 percent identifying it as an OpEx target of opportunity.

Nice Insight’s research reveals many drug manufacturers have shifted their focus to the development of new drug formulations and have outsourced their end production, such as commercial manufacturing and filling and closing operations, to contract manufacturers. “The trend to more complex formulations has led to a higher demand for sophisticated technologies,” says Tiene, “while the trend toward small amounts of targeted drugs calls for flexible platforms that can handle small batches and ensure the highest safety for operators and products.”

Considering the trend of seeking new opportunities for shifting capital expenses to operating expenses, how did readers characterize such activity (if it was occurring) at their companies? Most respondents (30.4 percent) characterized activity in this area as “Traditional; accounting practices are consistently applied using standard norms to assign capital and operating expenses.” Some are working on it, with 24.4 percent responding they are “Piloting; beginning to explore the possibilities and trialing suppliers and vendors that support formalized operating expense accounting initiatives.” Another 24.4 percent indicate activity is “Increasing; we are seeking partners and suppliers that support this operational/financial necessity.” Finally, 20.9 percent chose “Random; not necessarily a part of any deliberate strategy, but being used to help the balance sheet” to describe their company’s less-than-deliberate approach, however amenable they are to the idea.