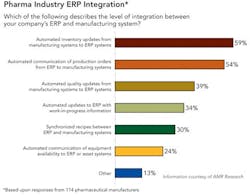

Most pharmaceutical companies have invested in enterprise resource planning systems (ERPs), but few get enough bang for the millions of bucks these platforms cost. Its as if they bought a Lexus loaded with all the extras, but only use it to drive around the neighborhood. Most [drug] companies are using ERP for the bare minimum, says Eric Bloom, vice president of information technology at Endo Pharmaceuticals (Chadds Ford, Pa.). To realize the promise of ERPs, pharmaceutical manufacturers must fully integrate them with plant systems such as manufacturing execution systems (MES), quality management systems (QMS), and software for targeted applications such as radio frequency identification, or RFID. For most pharmaceutical companies, the biggest issue is, How deep should I take my ERP system into manufacturing? says Roddy Martin, vice president for life sciences industry strategies at AMR Research in Boston. A tighter connection between business-level (ERP) and plant-floor systems is desirable for a number of obvious reasons: to track inventories, schedule production, monitor work in process, manage quality data, and keep tabs on materials consumption. Yet, few pharmaceutical firms have achieved the level of integration required. A lot of data such as information surrounding orders, inventory and materials are not automatically entered into MES and sent back to the ERP system, Martin points out. Very few companies are doing this.And Martin has the statistics to support this point. Only 59% of respondents to a recent AMR survey of 114 pharmaceutical manufacturers said that they had automated updates of inventory data from their manufacturing systems to ERP (see graph, Pharma Industry ERP Integration, below). Just 39 percent roughly 2 out of 5 companies reported having automated quality data flowing from the plant systems to ERP. Historic disconnectThe lack of integration between the plant floor and the office-based systems goes back to ERPs origins as a high-level system designed to plan materials needs, keep track of shipped orders, and handle receivables and payables. Despite all the hype about manufacturers needing real-time data from the plant floor, most ERP software vendors paid little heed to what was actually happening in manufacturing. Manufacturing, instead, became the purview of MES, and manufacturing departments were either left on their own, or forced to hire systems integrators to tie ERP with these plant-based information systems. At some pharmaceutical companies, the level of integration between the plant and ERP has been so poor that operators must still enter data manually so that it can be uploaded to the ERP system. Nevertheless, a small but growing number of drug manufacturers are making major strides to achieve greater integration between systems. At the same time, software vendors are taking steps to ease the difficulties involved in tying together disparate systems and software packages.Systems integration, particularly between ERP and MES, is getting easier all the time, says Dan Miklovic, vice president and manufacturing research leader at The Gartner Group (Stamford, Conn.). Both Miklovic and AMRs Martin point to the new business data standards for plant-to-office software connections supported by SAP and Microsoft Corp. Proprietary interfaces are not going to work, says Jim Sabogal, director of the life sciences industry business unit at SAP, which is promoting the S95 standard for an ERP-to-plant-floor interface. One reason for the push toward greater integration is a growing awareness among pharmaceutical firms that they need to move to a single system for product data. When you have a lot of disparate systems, its difficult to get solid information, adds Doug Souza, vice president of process manufacturing and configuration development at Oracle Corp. Compliance and traceability requirements are also fueling this trend, says Miklovic says. More drug companies are asking, Can we make our ERP the system of record? There are significant savings to having integrated data when you need to do product tracking, he says. Inertia and complacencyUnfortunately, a number of issues still impede integration. One is inertia, followed closely by validation. ERP systems are huge, and once theyre installed and in use, companies are reluctant to change or upgrade them, and trigger revalidation.Add RFID data to the mix, and the potential for information overload is high. These businesses already have a lot of data they dont use, Martin says. If they had more information, they wouldnt know what to do with it. Complacency has been another impediment to integration. As Martin puts it, A lot of pharmaceutical companies are running with 200 days-plus of inventory because its cheap. Given the industrys traditionally high margins, there had been few incentives, historically, for manufacturers to make significant improvements.However, this situation already appears to be changing. Cost containment and quality improvement appear to be the leading drivers for investment in pharmaceutical plant floor data systems today. Nearly two-thirds, or 63%, of business (non-IT professionals) respondents to the AMR survey reported that controlling costs was the primary driver for investment in plant floor systems, while 53% said that product improvement was the motivator. About one in four said that managing yield across sites was the primary driver. And only four percent of business respondents indicated that visibility into inventory for available-to-promise purposes was the leading motivator for their companys investment in systems to collect and manage plant-floor data.Despite the danger of data overload, Miklovic believes that more drug companies will either purchase new ERP systems or upgrade existing ones to handle RFID data captured on the plant floor. RFID is going to drive SAPs and Oracles ERP business because manufacturers need a way to store and access that information, he says. AMRs Martin envisions a more gradual transition to newer ERP technology over the next three years especially when it comes to linking RFID data. MES shakeout?The software industry will also be affected by the need for tighter connections between ERP and the plant floor. Just as ERP vendors began to include customer relationship management (CRM) software and advanced planning and scheduling (APS) modules, MES may soon become a module for ERP, Miklovic predicts. In five years, there will be very few MES companies, he says. Martin, for one, questions whether that would be a good thing. ERP is a planning system, and companies need to define a standard integration layer between manufacturing and ERP. They get operations excellence from a manufacturing system, not ERP. Despite this traditional separation of functions, both MES and ERP software vendors are taking an aggressive approach, each encroaching on the others turf and claiming it can perform the others functions. The MES vendors will tell you they can do inventory management and materials management, and the ERP companies will say they can go down and do things on the manufacturing floor, observes Martin. Neither of these approaches is a very good idea, because there needs to be a very clear line with clear information flows between these systems.For years, one of the rubs against ERP systems was that they took too long to install. In fact, a large drug distributor made headlines in the 1990s by suing its ERP vendor and implementation consultant. The company claimed that implementation costs and overruns had driven it to bankruptcy.Today, most ERP vendors offer tailored packages that simplify installation, although most customized solutions must still be tweaked to fit individual business processes and methods. You have to do some customization, Endos Bloom says. Nevertheless, the customized solutions have been a help. For the generic drug manufacturer Lannett Co. (Philadelphia), a preconfigured pharmaceutical industry solution was instrumental in allowing the company to get its ERP system up and running in only eight months, says Greg Liscio, Lannetts SAP project manager and IT.Liscio has found that the platform has helped Lannett improve speed to market, a key issue for any generic drug manufacturer, but also, to sharpen its supply chain management. Our competitive edge comes through managing our production cycle time, our supply chain and our inventory, Liscio says. Managing materialsFor large manufacturers trying to manage and plan materials needs for multiple plants, ERP has proven helpful in inventory management. It helps us manage the long lead times required for ordering ingredients for our products, says Christine Sheehy, vice president of operations at Three Rivers Pharmaceutical in Pittsburgh. At Colorcon (Lansdale, Pa.), which manufactures film coatings for tablets for some of the largest drug manufacturers, Oracles ERP solution is used to manage all customer and product information for seven manufacturing facilities in Asia, Europe and the U.S. For a customer such as Pfizer, we must be able to guarantee that, worldwide, the product is made with the same ingredients in exactly the same way, says CIO Perry Cozzone. Colorcon also depends on its ERP system to obtain a worldwide picture of operations, and to trace product batches all the way back to the weighing and dispensing of materials on the plant floor. Our MES uses wireless radio frequency devices and interfaces back to the Oracle system, Cozzone explains. Even if more of them arent taking action, a growing number of drug manufacturers realize the benefits of integrating customer order information, work-in-process data, and quality information upstream into the ERP. As this trend continues, this underachieving software platform promises to deliver on its unfulfilled promise: real-time access to manufacturing and other data, at any time, throughout the enterprise.Pharma Industry ERP Integration

About the Author

Doug Bartholomew

Contributing Editor

Sign up for our eNewsletters

Get the latest news and updates