Pharma Sharpens its Game: Results of Our First OpEx Survey

By Agnes Shanley, Editor in Chief

The drug industry has begun to embrace the principles of the Toyota Management System, the Japanese reinterpretation of concepts first advanced by Deming, Ford and Shewhart. It may have arrived at this point some 20 years later than in other manufacturing sectors, but more drug companies are taking a systematic approach to improving the way that they develop, manufacture and distribute drugs.

| Editor's Note: The majority of the graphics (pie charts, tables, etc.) for this article appear at the end of the article. In some cases, as at left, live links (in blue) will be provided to allow readers to "jump" directly to referenced information. |

Pharmaceutical Manufacturing, with sponsorship by Invistics Corp. (see "Who Took the Survey?" below), recently surveyed industry professionals to get some idea of how many of its readers’ companies are on the path of operational excellence, and to lay the foundation for tracking their progress. This article summarizes some of our findings.

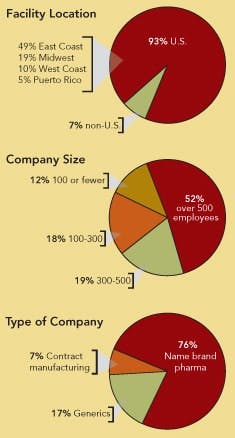

Some 114 individuals responded to this initial survey (see "Who Took the Survey?" below), most of them from brand name drug companies, nearly 20% from generic drug manufacturing companies, and about 10% from contract manufacturing firms. Over half responded anonymously, and over 90% answered “off the record.”

The number of responses varied with each question, with a core group of 50 replying to every question in the survey. Although the sampling is small — and our survey a “work in progress” that will develop into a statistically relevant sampling over time — results still offer a glimpse into pharmaceutical manufacturing practices today, highlighting achievements as well as areas where improvement is needed. They also suggest that some drug companies are only beginning their operational excellence and continuous improvement programs.

Among the encouraging trends:

- Most respondents describe their facilities’ operational excellence programs as closely aligned with their companies’ corporate missions and overall business goals;

- For the most part, respondents say, they are getting clear key performance indicators (KPIs) from management;

- Manufacturing teams are viewed by most respondents as being critical to improving efficiency and performance;

- More companies appear to view plant and equipment maintenance “strategically”;

- Companies are working continuously to reduce set-up times; many of them report that they have already achieved results.

Trouble spots

Other findings were inconclusive, or potentially troubling:

- While 56% of respondents believe that top management views their facilities as profit centers, 44% think that corporate management sees them as cost centers. 57% of generics manufacturer respondents say that corporate managers view manufacturing as a cost center;

- Customer input may not be as integral a part of the overall improvement process at drug manufacturing facilities as it is in other industries;

- Nearly half of the respondents note a need to motivate continuous improvement from the plant floor-level up;

- Most respondents say that their facilities and organizations aren’t tying manufacturing employees’ compensation to plant efficiency and product quality improvements that they make on the job;

- At some facilities, manufacturing employees may not be taking ownership of QA and QC, believing that these should be left to the quality department;

- Cross-functional training and product development appear to be issues for some companies; several respondents note a lack of communication between R&D and manufacturing;

- "Visual" workplace strategies such as 5S and minimization of waste and motion appear to be less developed at drug manufacturing facilities than they are in manufacturing plants in other industries;

- Respondents cite “process innovation” and “reducing product prices” as low in their companies’ priority lists.

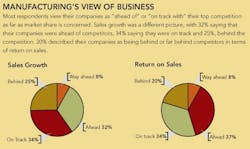

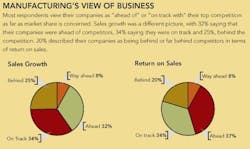

In addition to asking manufacturing professionals about their priorities and views of key manufacturing issues, we also asked them to describe how their companies were performing overall, compared with top competitors (see the following graphics).

We also analyzed responses from those who felt that top management viewed their facilities negatively (see "Facility Self-Image" below).

Business and manufacturing priorities

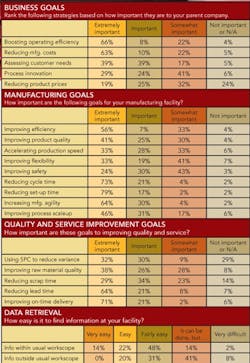

Respondents are clear about what keeps them, and their managers, up at night. Overall, they view their companies’ top priorities as: increasing operating efficiency, reducing manufacturing costs, and assessing customer needs, which between 73% and 78% of respondents describe as either “extremely important” or “important.”

Process innovation is seen as less of a business priority, with 53% describing it as important or very important. Reducing product prices ranks even lower on the priority list, with 44% saying it is important or very important.

For their manufacturing operations, respondents describe their top day-to-day goals as: improving product quality (67%), boosting overall efficiency (63%) and increasing production speed (61%). Improving workplace safety (54%) was a bit lower on their facilities’ priority lists.

Key areas of focus appear to be: reducing set-up time (96%), increasing manufacturing agility (95%) and reducing cycle time (94%). Improving process scaleup is less of a priority, with 77% calling it important or very important.

Improving quality

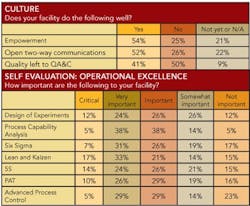

Respondents appear to be divided about who is responsible for product quality improvement. Where half of the respondents say quality is not just the responsibility of QA and QC, 41% say that it is, and 6% suggest that they haven’t really answered that question at their facilities yet.

Responses also indicate that drug companies may be somewhat divided on how best to improve product quality. 64% say that improving raw material quality and supplier performance is important, very or extremely important; 62% use these terms to describe using statistical process control (SPC) to eliminate process variability, and 63% describe reducing scrap time this way. In each case, though, as many as 30% do not view any of these strategies as important.

Replies suggest that SPC may be gaining ground in generics manufacturing operations. Although none of the respondents from generics companies describe any of the three approaches as extremely important, 66% of respondents say that reducing process variance with SPC was either “very important” or “important,” compared with 52% of overall respondents. 55% of respondents from generics companies describe “improving raw material supply quality” and “reducing scrap time” that way.

When asked how often SPC is used to reduce process variance, 36% of all respondents answer “sometimes,” and 34%, “rarely.”

Service improvement

Respondents describe “improving on-time delivery” as the critical customer service improvement goal, with 92% of overall respondents describing it as important, very or extremely important; 85% of respondents describe reducing lead time that way.

Although much has been written about slow product introductions in the industry, 34% of overall respondents (75% of generics manufacturers) say that three or more new products were introduced at their facilities last year, and more than half of all respondents (44% of respondents from generics firms) saw three or more new SKUs at their sites in 2005. However, 24% of overall respondents (33% of generics respondents) and 19% of all respondents (25% of generics) saw no new product introductions.

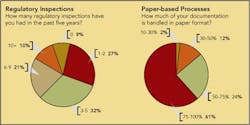

Manufacturing facilities must make improvements while dealing with regulatory inspections. 32% of overall respondents say that their plant has had between 3 and 5 inspections by FDA and other regulatory authorities over the past five years. For generics respondents, 44% have had 1 to 2 inspections during this period.

Aging assets

Results suggest that drug manufacturers are doing more with older equipment. Respondents note that 37% of equipment at their facilities (45% for generics) is over 10 years old. 61% indicate that 75% to 100% of their documentation is handled in paper format. Overall, respondents say that 54% of their equipment is manually operated (64% for generics manufacturers).

Data are relatively easy to find at most respondents’ facilities. Overall, 36% of respondents describe it as very easy or easy to find data on production, SOPs, batch records, quality or other key characteristics. 48% say that it is fairly easy to find such data, while 16% say it is fairly or very difficult to find.

When information is outside a typical sphere of activity (such as when a quality professional wants production equipment maintenance data), it becomes more difficult to find information. None of the respondents describes retrieval of such data as “very easy,” 20% say it is easy, 31% fairly easy, and 49% say it is fairly or very difficult to find.

79% of overall respondents say that “top-down commitment” to operational excellence is good to excellent at their facilities, with 25% saying it is “fair” or “needs improvement.”

Bottom-up involvement is a different story. Where 58% see it as good to excellent, 34% say it is fair and 8% say it needs improvement. 46% of respondents describe workforce integration as good to excellent, but 34% describe it as fair, and 20% say it needs improvement.

Stepchild syndrome

Responses indicate that manufacturing may still be viewed as a “stepchild” at some companies, particularly at generics firms. 52% of respondents (22% of those who responded from generics manufacturers) say that manufacturing managers’ input is critical to corporate strategy development, but 33% overall (and 56% of generics respondents) say that this input is not important in corporate strategy development.

Where 40% respond that R&D and manufacturing communicate very well most of the time, 56% say that such communication occurs only sometimes or rarely. 58% of respondents describe manufacturing engineers at their facilities as fully involved in new process or product development, but 42% say that this involvement sometimes, rarely or never occurs. Similarly, 49% describe product and process development as closely linked, where 51% say it is linked sometimes, rarely or never.

As far as employee empowerment is concerned, 54% of respondents say that their facilities empower staff to make continuous improvements, but 25% disagree (as did 44% of respondents from generics companies) and 21% say they “aren’t there yet.” Where 48% of all respondents (22% for generics) say the plant floor actively drives suggestions for improvement, 26% overall (66% of generics respondents) disagree, and 21% say that their facilities “aren’t there yet.”

Only 34% of overall respondents say that compensation is tied to on-the-job improvements that lead to productivity gains. 36% of overall respondents say that this is not the case, and 23% say their facilities aren’t doing this yet.

Cross-training

Results indicate that some drug companies may need to establish a balance between maintaining centers of specific skills and expertise at their plants, and providing employees with skills that offer a window to the “bigger picture.” According to 57% of respondents, employees at their sites can be deployed to different work areas, but 32% say this is not the case, and only 33% describe their facilities as having strong cross-training and employee rotation policies.

40% of respondents describe their facilities as being in frequent touch with their customers, but 60% say that such contact occurs sometimes, rarely or never. 33% of respondents say that they conduct customer satisfaction surveys always or often, 31% do it sometimes, and 36% rarely or never. Only 30% jointly develop business processes with suppliers. 32% do this sometimes and 34% rarely or never.

Maintenance

66% of respondents say that they have “excellent” or “good” preventive maintenance practices in place. 22% describe their facilities’ maintenance programs as fair and 15% as barely adequate, but “visual” practices may not be implemented: Only 29% of respondents say that they post relevant maintenance plans and checklists near machines. 69% say that this is done sometimes or not at all. Only 22% involve operators in new equipment purchase decisions. 31% do this sometimes and 45% do not do it at all.

Use of technology, tools

Only 29% of respondents say that their facilities are using new technology effectively. 43% say that this may be true in some cases, while 26% admit that it is an area of weakness.

As far as tools and methodologies are concerned, 81% of our respondents view process capability analysis as important to critical in their opex programs, 71% describe Lean and Kaizen that way. 65% view process analytical technologies (PAT) and set-up time reduction as important to critical, 64% describe 5S and Six Sigma that way, and 62%, Design of Experiments.

Who Took the Survey?

114 people responded to the survey, most of them from the U.S. and Puerto Rico, with 7% from outside the U.S. Over half work at large facilities, with over 500 employees, nearly 20% at facilities with 300 to 500 people, 18% at plants with 100-300 people and the rest at smaller facilities with fewer than 100 employees.

About the Survey Sponsor

Invistics helps manufacturers in highly variable, asset-intensive industries such as pharmaceuticals achieve operational excellence in an often overlooked, yet core, element of their supply chain — production operations. Built on Lean and Six Sigma principles, its manufacturing performance optimization solution, Invistics MachSix, is specifically designed to redefine complex plant-level tradeoffs between inventory costs, customer service, production throughput, and cycle times. Companies can use its methodology and software to identify and manage sources of variability while breaking down organizational silos, and some have achieved dramatic, sustained results including over 99% on-time deliveries, an average reduction of 50% in inventory and reduction in cycle times by more than half. MachSix integrates with and enhances ERP and manufacturing applications by providing more accurate data while accounting for variability and improving visibility into plant floor health. To learn more about Invistics, visit www.invistics.com or call 800-601-3456.

* Several questions in this survey were based on those in a 2004 survey by the University of St. Gallen’s Center for Technology Management