The biopharma industry’s continued focus on process efficiency is being fueled by advances in biosimilars, smaller volume drugs, shorter drug lifecycles (faster trials, development cycles), and high-volume product manufacturing issues.

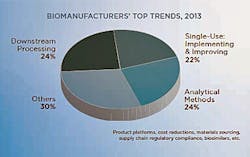

To evaluate the trends that are shaping the bioprocessing segment today, BioPlan Associates recently surveyed 450 global subject matter experts and senior participants on its Biotechnology Industry Council panel of bioprocessing professionals and asked them to identify the most critical factors and trends they expect will need to be addressed over the coming year. While ‘process efficiency’ was a unifying thread, three clear sub-topics emerged: downstream processing; analytical methods development; and single-use system integration. (1) This year, the industry will see an increase in multi-product facilities, selective single-use adoption (both in clinical and commercial stage), a ramping up of continuous processing, and more advanced automation and monitoring. With downstream processing continuing to lag improvements in upstream, the industry will continue to look for better performing chromatography resins and consider alternatives to protein A.

Downstream Processing

Downstream purification (separation, filtration and chromatography) continues to be a culprit behind facilities’ capacity constraint problems. It counts as one of the key areas that the biopharmaceutical industry believes must be addressed to avoid short- and long-term capacity constraints, and it is where a large number of industry suppliers and end-users are developing and evaluating new technologies and other options for improving production efficiency.

Biopharmaceutical manufacturing, due to the fact that it operates in a highly regulated environment, tends to be characterized by incremental improvements rather than rapid, major technology shifts associated with other less regulated or consumer-oriented industries. The problem has been that with the significant increases in protein expression levels over the past several years, pressure has shifted squarely to downstream operations, which have not seen the same degree of improvement. This, in return, has resulted in continued bottlenecks in purification and filtration operations. The issues experienced by downstream operators have remained relatively constant over the past few years. And although there are many new technologies under investigation and consideration, few as yet, are being actively implemented.

This year’s trends study revealed 24% of industry participants named downstream processing as the single most critical trend. By contrast, 5% said the same about upstream processing. Within the rather broad area of downstream processing, the research reveals several sub-trends including:

• Process improvements in bioburden control in chromatography columns;

• Development of non-chromatographic recovery unit operations;

• Improving harvest operations through novel technologies;

• Increasing protein concentration in solution, without reducing yield; and

• Purification related to impurity profiles in biosimilars.

There is a general perception that the industry needs better-performing chromatography resins. Results from last year’s 9th Annual Report and Survey of Biopharmaceutical Manufacturers2, in which more than 300 biomanufacturers were surveyed, showed that slightly less than one-third of respondents wanted suppliers to focus efforts on chromatography products, the third-most sought after new product development area of the 21 we identified. (2)

There appears to be some consensus that alternatives to protein A will continue to be sought and developed this year. It is worth noting that while the industry has been clamoring for alternatives to protein A purification for some time, few facilities have made such a switch. For example, last year’s survey revealed 16% of respondents considering alternatives to protein A for existing projects, but less than half that proportion (7%) offer that they will actually be moving away from protein A for existing scale-up or commercial production units over the following 12 months.

In fact, the study found that the long-term trend among facilities interested in protein A alternatives appeared to be decreasing for new production units, while there was modest interest in switching from protein A for existing scale-up and existing production units. In general, though, interest appeared to be waning.

Using protein A chromatography media remains problematic because of the high-cost, limited life of the material and the cost of cleaning/validation. Alternative methods for purification of antibodies have been, and are being developed with longer lifetimes and therefore lower cost per unit of protein produced. However, according to most end-users, protein A “works.” While general interest in alternate purification methods to protein A remain high, actual switching behavior seems to be static or declining.

Still, the environment is ripe for innovative alternatives to emerge, and as long as downstream processing remains in the conversation, alternatives to protein A will be an ongoing topic of discussion.

Analytical Methods

In most biomanufacturing segments, it appears that improvements in assays and analytical capabilities are needed or desired. In addition to the continuing needs to assess and document product composition and quality, new demands for assays and analytical capabilities for biosimilars range from proving similarity to determining the unique differences between products. Assays and analytical method improvements are also needed to increase productivity in active agent design, discovery, screening and optimization, as there are too many products continuing to fail very expensively later in development. Most all can agree that it’s preferable to have products fail fast in order to move on to the next, most promising candidate in the development pipeline.

According to the evaluation study’s results, almost one-quarter (24%) of industry experts tabbed analytical methods development as the top trend of 2013, on par with the percentage citing downstream processing. Common micro-trends within this area included:

• Convenient, high-throughput assays that assess physicochemical properties IgG clones for high level expression and therapeutic efficacy;

• Demonstration of biosimilarity to reduce costs of biologics manufacturing, and analytics to demonstrate equivalent product quality;

• Development of better characterization tools for upstream analysis and optimization; and

• Improved high throughput, high resolution glycoslylation analysis.

Clearly, there are multiple addressable dimensions to this topic, and we found a similarly wide net in last year’s Annual Report study where we inquired as to which assay areas most urgently required new or improved testing methods. That is, of the 29 “areas” we identified, 10 were cited as urgent by at least 20% of respondents. These included:

• Bio-assays to assess potency for release of drugs (41%),

• Biophysical characterization during process development (35%),

• Glycosylation (33%),

• Better stability assays (32%), and

• Biotech drug comparability (in-house manufacturing changes and biosimilars (31%).

Preliminary data from our 10th Annual Report and Survey of Biopharmaceutical Manufacturers3 (due to be released in April) indicate that the industry is looking for innovation in this area, ranking it near the top of the list in terms of new product development areas of interest among respondents.

Single-Use System Integration

Although analytical assays rank towards the top of biomanufacturers’ new product development interests, single-use, disposable products are at or near the top of the list. Preliminary data from the study reveals that end-users are interested chiefly in disposable products, bags and connectors (49%), while also expressing a desire for improvements in disposable probes and sensors (30%), disposable bioreactors (29%), and disposable purification (29%). These areas have been consistently in demand for several years now.

Disposable devices continue to make advances in manufacturing and are becoming increasingly common in most areas of biopharmaceutical production. Although, as yet, there are few non-rigid single-use devices (e.g., bioreactor bag liners) used in commercial scale GMP applications, it is likely this will change quickly as new products move through the development pipeline and out of clinical-scale manufacturing. Further, as regulators gain familiarity with the safety profiles and materials used in such devices, necessary approvals for product manufacture are apt to accelerate as well. When this occurs, the market volume for single-use devices is likely to increase significantly.

This year, 22% of the Biotechnology Industry Council members surveyed believed that single-use system integration would be the key trend for the year. Within this burgeoning area, participants identified several sub-trends. These include:

• Building quality into single-use operations to further reduce regulatory activities/oversight;

• Fixing disposable bioreactors that create inconsistent growth due to changes in resins, films, gamma irradiation, and cell line specificity;

• Downstream operations using membrane adsorbers;

• Emergence of flexible and modular biomanufacturing facilities;

• Establishing leachables and extractables guidance for testing;

• Improved upstream contamination investigations from a QA perspective;

• Introducing single-use devices at GMP commercial scale manufacturing; and

• Leachables and extractables [standardization] at clinical and commercial scale.

There are two interwoven trends worth an additional look. The first regards leachables and extractables. Last year, there were reported problems with the reliability and performance of available disposable solutions, with leachables and extractables a key factor. As Rick Johnston, Ph.D., CEO of Bioproduction Group Inc. noted, these issues “undermined confidence in the ability for … manufacturers to supply material in a timely manner to support production. This led many biomanufacturers to aggressively pursue dual-sourcing and risk-mitigation strategies like holding large inventories, both of which raise overall production costs. It is hoped that in the 2013 time period these issues can be resolved to allow the promise of disposables to be realized in the biomanufacturing setting.”

Indeed, the emergence of flexible and modular facilities, as well as the adoption of single-use devices at GMP commercial scale manufacturing (something already underway) depends in part on resolution of leachables and extractables (L&E) problems. In our 9th Annual Report, we asked respondents to identify the factors that may restrict their use of disposables in biopharmaceutical manufacturing. Fully 7 in 10 (69%) either agreed or strongly agreed that L&E problems were a concern, beating out bag breakage and single-source issues as the most common factor restricting further adoption of disposables. And when respondents were asked about identifying the single most important reason for not increasing their use of disposable technologies, concern regarding L&E headed the list again.

The debate over L&E data continues, but a major concern that end-users struggle with is that the raw material sourcing sometimes is unregulated, putting them at a disadvantage. Because vendors deal directly with raw material providers, end-users feel they are in a better position to test and provide the necessary L&E data as supporting documentation for their products. The desire for this type of data is strongest among scale up/clinical development organizations that do not have the resources to conduct such tests in-house. On the other hand, late-stage manufacturing organizations that are in phase III or commercial production are unwilling to take a chance with vendors and would rather generate L&E data themselves to minimize regulatory risks.

If the L&E problem can be addressed, then it is likely that the use of disposables in biomanufacturing will grow more rapidly. While the wheels have been set in motion, the remaining hurdles still need to be cleared. Members of BioPlan Associates expert council believe that the L&E roadblock could be addressed this year.

The trend evaluation study revealed that three topics — downstream processing, analytical methods, and single-use systems — will dominate industry attention, both among end-users and industry suppliers. But it is important to remember that many other trends and themes are certain to shape and influence the market. Product platforms, cost reductions, materials sourcing, supply chain regulatory compliance and biosimilars will all make headlines in one form or another.

- When 2013 comes to a close, the industry will be looking to answer three key questions:

- Did we see significant improvements in assay development that meet the current and emerging industry demands?

- Was 2013 the year that L&E problems (and related supply chain management issues) were finally put in the rear-view mirror, and a jump in single-use adoption at commercial scale emerged?

Stay tuned for the answers.

References:

1. BioPlan Associates’ “2013 Biotechnology Industry Council Trends Analysis Study”

2. 9th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, April 2012, Rockville, MD,

www.bioplanassociates.com

3. 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production, Preliminary Data, Release April 2013, Rockville, MD, www.bioplanassociates.com

Published in the March 2013 issue of Pharmaceutical Manufacturing magazine

About the Author:

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is editor of numerous studies, including “Biopharmaceutical Technology in China,” “Advances in Large-scale Biopharmaceutical Manufacturing,” and many other industry reports. Contact: [email protected]; 301-921-5979; www.bioplanassociates.com

Survey Methodology: The 2013 10th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity and Production in the series of annual evaluations by BioPlan Associates, Inc. yields a composite view and trend analysis from over 300 responsible individuals at biopharmaceutical manufacturers and contract manufacturing organizations (CMOs) in 29 countries. The methodology also included over 180 direct suppliers of materials, services and equipment to this industry. This year’s survey covers such issues as: new product needs, facility budget changes, current capacity, future capacity constraints, expansions, use of disposables, trends and budgets in disposables, trends in downstream purification, quality management and control, hiring issues, and employment. The quantitative trend analysis provides details and comparisons of production by biotherapeutic developers and CMOs. It also evaluates trends over time, and assesses differences in the world’s major markets in the United States and Europe.

About the Author

Eric S. Langer

Eric S. Langer

Sign up for our eNewsletters

Get the latest news and updates