When it comes to careers, many of Pharmaceutical Manufacturing’s readers made their choices early, completed their undergrad and graduate level studies then embarked on careers that offered stability, growth, first-class compensation and benefits and stability. That sounds redundant, of course, but for decades careers in Pharma were as predictable as they were stable.

Respondents to Pharmaceutical Manufacturing’s 9th Annual Salary and Job Satisfaction Survey provide demographics to support the conjecture. Of the nearly 400 respondents, 49.5% are over 40 and another 29.1 percent are over 55. Most (nearly 40%) have been employed by the industry for more than 20 years. Current salaries also point to stable, progressive careers with the majority of respondents earning more than $100,000 annually.

Unfortunately, about two-thirds of the way through their chosen profession, many in the industry experienced dramatic and sudden shifts as company after company began to restructure or consolidate to survive myriad competitive and economic pressures.

The layoff statistics for the decade past are chilling. Chicago recruiting firm Challenger, Gray & Christmas reported last year that from 2000 to 2011 the drug industry suffered through nearly 300,000 layoffs, the high, or low point (depending on one’s point of view) reached in 2009 when some 61,000 were “adjusted” out of their positions. Fortunately for many, the statistics also reveal that overall headcount in the industry did not fall by that much. Although the industry has supported the reassignment of many of these employees, the numbers do reveal that a tremendous decade-long “churn” occurred.

The churn seems to be abating, with layoff statistics trending dramatically lower for the second year in a row. Challenger, Gray & Christmas reported just 1,034 layoffs for January-February 2013 compared to 4,336 layoffs during the same period in 2012. “It’s true that the pharmaceutical industry over the last couple of years went through a wave of job cuts and restructuring,” says Challenger, Gray & Christmas CEO, John Challenger. “And perhaps got out ahead of it a bit, but the industry did what it needed to do to thin down; now it is looking at the new Healthcare [Act] and what it’s going to be.”

Reading between the lines, the statistics support the supposition that companies have found the floor when it comes to staffing levels which, more often than not, translates to very lean org charts and overextended employees. Survey results find the majority, just under 54%, did not take all their vacation time last year, and 19.3% (about a 2% increase over 2012) feel stressed and burnt out most of the time. When asked “Is burnout a problem among those you work with?” the majority (45.4%) responded that “Yes it’s a real issue for us and is hurting our productivity” bumping up from 38.7% from last year.

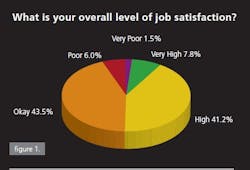

Burnout is prevalent, but how much does that impact job satisfaction? Survey responses to “What is your level of job satisfaction?” reflect that people may be getting a little more used to the new normal (see figure 1). Although “High” satisfaction is down (41.2% from 44.1%), “OK” responses were up (to 43.5% from 35%) with the “Poor” responses down 4%. “Very Poor” responses stayed about the same. What drives job satisfaction of pharma workers? About what you would expect from superbly educated, highly motivated professionals: 31.5% find “Challenging Work” brings them the most satisfaction. True, salary and benefits hold second place, but compared to other motivators those seeking job fulfillment lead. Of less concern, at least for those responding, is job security—perhaps recent experience has tempered those fears.

With staff fat long gone and some of its muscle cut to the bone, will the industry return to more robust hiring and eschew more cutting? According to Challenger, the industry is benefiting from a stronger economy: “Each year we get away from the recession there is less concern, but in some ways it’s too early to tell because of the uncertainty in the economy and the potential negative impact of the health care reform.” There might be a silver lining, says Challenger, remarking that there is real potential the Affordable Health Care Act will have a positive impact on hiring. “Yes, it just might. Potentially there will be more than 40 million new people that will have access to health care and medicines — that may not have had access — [pharmaceutical manufacturers are asking] will there be more demand for our products? Will there be pressure on pricing? How is going to cause the structures of our organization to change?

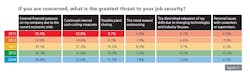

Uncertainty breeds uncertainty, and anxiety about the prospects of keeping one’s job is generally ever present. But stress over job security is just part of the new normal for most rank-and-file employees and response to the question “Are you concerned with job security?” is 63.1% “Yes.” Relative to years past, yes responses were virtually the same as last year, revealing that anxiety levels trended lower from its peak (69.7%) in 2011 and has been stable for two consecutive years. Driving anxiety among respondents is the current state of the economy and the “External financial pressure on my company due the current financial crisis,” and the effect of “Internal cost cutting measures.” The fear of losing one’s job to internal pressures to cut cost is what most Pharmaceutical Manufacturing survey participants fear most, up slightly to 42.8% (see figure 2). And although the term “financial crisis” may not aptly describe the current economy anymore, the responses show that about a third feel this is the other primary threat to job security. Regardless, the industry will continue to recast itself and form new alliances in response to market and economic dynamics.

Financial powerhouse KPMG recently surveyed executives from 107 pharmaceutical and life sciences sector companies with revenues of more than $100 million; the majority (45%) earning more than $10 billion. According to KPMG’s 2012 Industry Outlook Survey,” navigating the regulatory environment and investing in organic growth will be the key focus of management over the next two years.

“Sixty percent of the executives,” say the report, “cite regulatory and legislatives pressures as the most significant barrier to their company’s growth over the next year.” What will drive revenue growth? KPMG survey respondents point to new therapies from their own research (52%) followed by therapies developed by alliance partners (36%) and growth from non-U.S. markets (34%). The upside here is that KPMG analysts reported that the zeal for using mergers and acquisitions to fuel growth has diminished, therefore tempering the staff consolidations and layoffs that inexorably follow such initiatives.

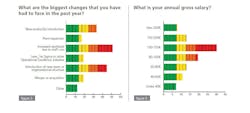

Although pharma executives are looking to drive revenue growth from internal growth, the responses to Pharmaceutical Manufacturing’s Ninth Annual Salary and Job Satisfaction Survey reveal these and similar business goals are likely to be earned on the backs of the current work force (see figure 3). When asked “What are the biggest changes you have had to face in the last year?” a little more than half chose “increased workload due to staff cuts” followed by “introduction of new team or organizational structure.” “New product introductions” also attracted about a third of respondents as well. Perhaps these figures tell more about potential job security — meaning staffing levels are as lean as they can get. But that begs the question: Is hiring going to rise? KPMG respondents reveal some ambiguity. “While 33% of survey respondents noted they added personnel over last year, 42% report a decrease in head count. Executives, continues the report have similar expectations for the year ahead with 38% predicting an increase in hiring as opposed to 37% anticipating a drop in headcount.

As far as the overall economy, responses from KPMG’s surveyed executives show cautious optimism with 54% expecting modest improvements and another 38% feeling things will stay about the same. However, a strong majority (70%) feel substantial economic recovery is still in the horizon, not occurring until 2014 or later. For Pharmaceutical Manufacturing’s respondents, the effect is more personal (see figure 4) with 57.8% percent feeling that in spite of the increase in duties and responsibilities fewer raises and promotions are being offered because of current economic conditions.

Let’s look at compensation. As mentioned, more than half of all respondents reported annual salaries past six figures. And while the upper limit for most is $150K, nearly 20% have salaries extending to over $200K (see figure 5). Interestingly, in spite of a majority responding the economy was holding employers back from doling out raises and promotions, a majority (56.7%) reported they had received a raise in the last year, representing an increase over last year’s 50.5% response. Down from last year were those responding their last raise was in the last 1-3 years, while those still waiting for a raise for more than three years edging up 9.1% from 6.3% last year. Of those getting raises, 67.3% percent say they received a 1-3% bump.

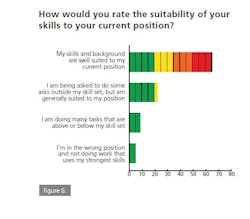

One’s professional skills, matched well to the demands of the position often spell career advancement, and responses reveal attitudes little changed from last year (see figure 6). According to 2013 respondents, 64.6% feel assured “My skills and background are well suited to my current position.” This may be doubly true in the biopharmaceutical space, which is experiencing its own renaissance and already recognized has a “hot” sector looking to hire the best talent to support this pharmaceutical industry segment’s tremendous growth.

According to New Chemistry: Getting the Biopharmaceutical Talent Formula Right, a recent PriceWaterhouseCoopers (PWC’s) Health Research Institute (HRI) survey of life science company HR and R&D executives, “A talent gap in the scientific workforce has biopharmaceutical companies searching outside for fresh skills and alternate approaches to R&D staffing.” PWC’s research found 51% of executives report that hiring has become difficult and only 28% feel confident they will have access to top talent.

Perhaps supporting that conclusion, respondents to Pharmaceutical Manufacturing’s survey find that to a certain degree their companies are imposing on them to make up for said skills “gap” responding to the question, “Do you see a skills gap or mismatch within your organization?” Some 42% answered: “Somewhat. Lately, we’ve all had to pitch in to do things outside our traditional domains.” Yet actions and intentions seem to be a bit at odds out there. Certainly the uptake of talent cast off from Big Pharma and other small molecule pharmaceutical companies over the past three years should provide a deep pool of talent from which biopharma can draw, but the PWC seems to counter that. But why the disconnect then?

Derek Lowe, who writes and edits the popular In the Pipeline blog posits there just might be demand and supply-side market dynamics at work “The whole ‘we just can’t find good people’ story does seem to be better phrased as ‘We can’t find good people for what we want to pay them.” Lowe contends that it is similar to the real estate market, when it comes to pricing: there are people on both sides who would like the prices to be other than what they are, and they’re willing to hold out to see if reality comes into line. Meaning the laws of supply and demand will balance. Until then, says Lowe, “well … if you’re willing to keep a position open for months and months because you want to save some money on the salaries, how crucial was that hire to start with? Who’s kidding whom?”

When Pharmaceutical Manufacturing revisits this survey a year from now, will things be all that different? Probably not, but there are good vibrations running through the industry and it is likely more people, not less, will be on board to support the strategic initiatives and business goals of the organizations they work for.

Lowe finds some things have gotten worse, but the cost of finding drugs the way it has always been done is unsustainable. “So unless we figure out a way to do that better, the nasty intersection of trends isn’t over yet … I’m not trying to forecast doom — people are still getting sick, and our longer life expectancies mean that we’re going to be around for a lot of things that we’ll want treatments for. There’s so much unmet need out there; we’ve only made tiny inroads into what’s possible. I’m a short-term pessimist and a long-term optimist.”

Published in the April 2013 issue of Pharmaceutical Manufacturing magazine

About the Author

Steven E. Kuehn

Editor in Chief

Sign up for our eNewsletters

Get the latest news and updates