The Impact of Inventory Turns on Speed, Quality, and Costs

Lean Management represents one of the most favored business improvement programs today. Pioneered by Toyota in the 1950s, Lean aims to eliminate waste in every area of the business, including customer relations, product design, supplier networks, and factory management. Its objectives include using less human effort, less inventory, less space, and less time to produce high-quality products as efficiently and economically as possible while being highly responsive to customer demand [1].

Although there is no universally accepted measure of a company’s “Leanness”, inventory turns are a reliable indicator. The trend of inventory turns over time indicates how well a company is progressing in terms of becoming more Lean and improving its processes.

How does the pharmaceutical industry rank on this measure compared to other industries? Unfortunately, at the very bottom. But by adopting Lean principles, Pharma companies can increase inventory turns and not only achieve significant financial benefits but also enhance competitiveness in the all-important areas of speed, quality and costs.

Inventory Turns as a Measure of Leanness

Inventory turnover—defined as the cost of sales (also known as cost of goods sold) divided by the average inventory level over some time period—is a convenient proxy measure of Leanness.

Recall that the goal of Lean is to achieve improvements in the competitive edge elements of speed, quality and cost. Lower levels of inventory directly correlate to improvement in these competitive edge factors, as we will show. That’s why Japanese manufacturers focus intently on reducing inventory, sometimes characterizing inventory as “evil.” Similarly, noted Lean experts such as Richard Schonberger view inventory as a catch basin for a multitude of business ills.

Inventory turns also straightforwardly correlate with the bottom-line measure of business success: cash flows. Reduced inventories mean more cash in the bank, freeing up cash that can be used for other purposes. However, reduced inventories are beneficial only if the reduction derives from process improvement—the core of Lean. If a company cuts inventories without improving processes, then stock-outs and lost customers will far outweigh any benefits of increased cash flows.

In addition, inventory is a standard financial metric and is readily comparable company-to-company, as well as over time within a business. It is also highly visible. Walk around a facility characterized by high levels of inventory and you can conclude that the facility is fat, not Lean.

The Impact on Speed

The impact of inventory on speed, quality, and costs becomes clear when a high inventory manufacturing environment is contrasted with a low inventory environment.

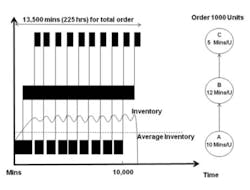

Figure 1

Although there is no absolute measure, comparisons with competitors can help determine whether a company is a high inventory or low inventory operation.

Suppose, for example, a company has an order for 1,000 units which are manufactured in a three-step production process that is run over two shifts, 16 hours a day, five days a week for a total of 80 working hours per week. In a traditional high inventory manufacturing environment (Figure 1), the material might be released from stores, processed and moved through the plant in a single batch of 1,000 units. That is, each operation completes work on the entire batch before any material is moved to the next operation. Each step processes and transforms the input materials incrementally.

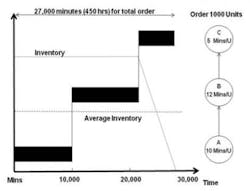

In this high inventory example, almost six weeks are required to complete the order. Compare that to the results from a low inventory manufacturing example (Figure 2) in which Lean principles such as setup reduction, flow layouts and pull production have been applied in order to reduce the batch size all the way through production. There is no longer any waiting until each operation is completed for the entire order before moving it to the next operation. Material is moved between operations in batch sizes of 100 units, allowing several operations to work on the same production order simultaneously.

In any production process the slowest operation acts as the constraint to the system and sets the throughput rate for the entire process. In this example, that constraint is the second operation, with a throughput rate of 12 minutes per unit.

Figure 2

Releasing material at a rate faster than the slowest operation will only cause build-up of inventory in the system. So an additional change must be made: release material into the system only to keep the constraint busy versus that of the high inventory environment in which the entire order is released to the first operation.

As a result of these changes, the work-in-process inventory level is much lower and the order is completed in half the time. This phenomenon is also demonstrated by Little’s Law, which shows that lead times are directly proportional to the amount of work-in-progress, i.e., inventory. Production lead times and work-in-progress inventory are mirror images of each other: reducing work-in-progress inventory proportionally reduces lead times. Therefore, if a product can be produced in less time, then capacity has, effectively, been increased—that is, the number of units processed per unit time increases. For both generic and brand drug manufacturers, the ability to ramp up quickly to meet surges in market demand confers a significant competitive advantage.

The Impact on the Cost of Quality

To understand the impact of inventory on quality costs, suppose that an out-of-specification (OOS) condition occurs at the first operation in our example. Unless in-process inspection is performed, this condition will be caught only after the entire lot is processed at that operation, possibly resulting in the entire order being scrapped. In this high inventory environment the damage will have occurred at least two weeks (as the first operation will take 10,000 minutes to complete) before it is detected, making it very difficult to determine what caused the OOS and leading to longer investigations. Also, the plant will be forced to expedite additional units because the order will now be very late. Under this pressure, management would likely devote its efforts to expediting rather than finding and resolving the problem.

In the low inventory environment, even if QC is not performed until the last operation is completed, and the damage is not detected until that point, the product is still being produced at the first operation. It is therefore much easier to determine the cause of the problem without being under pressure to expedite. Because the problem has been detected before the entire order has been produced incorrectly, fewer replacement units are required and they can be produced much more quickly than in the high inventory environment—and without resorting to expediting. Management also has the time and ability to eliminate the cause of the problem, perhaps permanently.

The Impact on Costs

Higher inventories result in greater material costs, operating expenses and capital expenditures. Recall that quality issues have a greater impact on a high inventory facility versus one with lower inventories. In the example here, an entire production order might have to be scrapped, increasing material costs. With shorter lead times than the competition, the lower inventory manufacturer also benefits from a more accurate forecast. For example, with seasonal drugs such as flu vaccines, the higher inventory manufacturer will have to begin production earlier than the lower inventory manufacturer. The longer the forecast horizon becomes, the more dramatically forecast accuracy decreases. Because the lower inventory manufacturer can start later, it will have a more accurate forecast and will be less likely to build excess inventory that may not be sold.

Further, the higher inventory environment will take longer to process an order than will its competitors. Faced with increased customer demands for faster response time, the higher inventory facility will have no choice but to increase production, either by adding additional shifts or overtime. With lesser operating expenses, the lower inventory competitor has a lower break-even point, giving the company more flexibility in pricing.

Even increasing the number of shifts or adding overtime may be insufficient. The high inventory facility may not have enough machines or labor to accommodate the load within the available time. As a result, this company may have to invest in more equipment. With less effective capacity than the lower inventory competitor, the higher inventory manufacturer will also have to invest in new facilities sooner.

Clearly, in the lower inventory environment the investment in equipment, facilities, and inventory is much less than that of the higher inventory environment. Consequently, the return on investment is much higher.

Where Pharma Ranks in Measurable “Leanness”

Since 1994, Richard Schonberger has been collecting inventory-turnover data in a long-range study of how companies are progressing with the Lean/process improvement agenda. His study groups about 1,200 companies into 33 industrial sectors. Table 1 lists the 33 industries in rank order, best to worst by long-term trend [2]. To assess a company’s performance, its inventory turns were graphically plotted year by year. A scoring system reduced this visual assessment of trends to numbers which point to long-term Lean progress.

Pharmaceutical companies rank at the very bottom. Of 66 pharmaceutical companies in the Lean database, only two merit a top grade of “A”, Johnson & Johnson and Japan-based Taisho. In fact, according to Schonberger’s research, the average score for pharmaceuticals has been going down since 2002.

Why has Pharma ranked so poorly? When profit margins were at historic highs, little attention was paid to operational efficiency and production costs. The focus of money and resources in Pharma has traditionally been on R&D rather than operations. The little attention that operations did get was focused on compliance rather than process improvement [3]. The standard practice of ensuring that more than enough of each product was available to meet customer needs coupled with a lack of attention to operational efficiencies has led to excessive inventories. Further, the sales and market-share strategy of pushing more and more inventory into the pipelines has also driven up inventories.

New pressures, however, are forcing a change in mindset. The government and society are exerting tremendous pressure on pharmaceutical companies to reduce costs and improve quality. As more brand drugs lose their patents over the next few years, price increasingly becomes a key competitive factor. The government is becoming the largest customer for drugs and is exerting enormous pressure on costs and quality. In addition, the global counterfeiting of drugs has increased the regulation of safety and quality.

Consumers are also bearing more of the costs of drugs. Managed Care Organizations (MCO’s) are implementing tiered cost-sharing formulas and increasing drug co-payments. The added out-of-pocket expense has prompted consumers to choose less costly generics or purchase cheaper versions from outside the U.S. Once a drug loses its exclusivity, the manufacturer who can produce the lowest-cost, high-quality product will likely win the market.

What Pharma Can Do to Improve Inventory Turns

A common objection to applying Lean in pharma is “that may work for automotive, but we’re different.” But consider how a real-world case study refutes the objection. A global pharmaceutical manufacturer, facing cost challenges at one of its plants, engaged consultants to help drive improvements using several different improvement approaches including Lean. The consultants and client team members worked together to create a value stream map of the production process. Improvement opportunities were identified and non-value added activities were identified and either eliminated or minimized. Of key importance was the implementation of a pull system, which resulted in lower inventories and reduced variability in the production process. Other Lean techniques such as set-up reduction were also applied.

Among the results:

- Work-in-progress inventory was reduced by 35% and production lead time was reduced by 56%.

- Scrap-in-tablet compression was reduced by 14%, resulting in more than $1 million savings in raw material costs.

- The conversion cost per unit was reduced by 22%.

- Direct labor productivity increased by almost 40%.

As in the example here, lower work-in-progress inventories correlate directly to reduced production lead times, improved quality and lower costs. Clearly, Lean principles are as applicable in pharmaceutical manufacturing environments as they are in automotive and other industries where they have produced similarly impressive results.

About the Author

Robert Spector is a principal for Tunnell Consulting. He has more than 17 years of management consulting experience with a proven track record of generating sustainable value for clients utilizing his expertise in Lean / Six Sigma, operations excellence, supply chain strategy, business process design, and information systems.

References

1. Spector, R. “How Constraints Management Enhances Lean and Six Sigma.” Supply Chain Management Review, January/February 2006.

2. Schonberger, R. Best Practices in Lean Six Sigma Process Improvement—A Deeper Look. Wiley & Sons, 2008.

3. Ibid

4. Goldratt, E., and R. Fox. The Race. North River Press, 1986.