Lean and Mean: How Does Your Supply Chain Shape Up?

For all the effort and ingenuity that pharma companies are putting into streamlining sales and operations planning, inventory management and logistics, major opportunities remain in the outbound supply chain, from packaging to delivery.

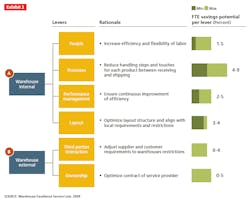

The typical pharma company operates a historically grown network with one or many warehouses in each country, different contracting terms and diverse transportation companies. Pharma logistics represent about 2 percent of sales, or 7-8 percent of the cost of goods sold, less than what we find in other industries (see Exhibit 1), and the outbound supply chain is often outsourced.

Under these circumstances, optimizing outbound logistics has not been a strategic priority for pharma companies. We think it should be — especially in light of current industry cost and performance pressures. Distribution is the logistical interface with the customer. Inefficient or unreliable warehouse operations and transportation cost more than money ó delivery delays can do quick and lasting damage to a company's reputation.

Companies have made significant improvements to manufacturing, service and maintenance operations through lean techniques: eliminating waste, inflexibility and variability in their systems and reducing costs by up to 50 percent in the process. Yet few apply the same lean techniques in warehouse operations or transportation, even though they can have a dramatic effect. These operations represent 95 percent of the pharma logistics costs and, in our experience, companies can save 20-50 percent in warehousing and up to 40 percent in transportation.

Companies that have run successful lean programs not only save money in warehouse operations, but also enjoy more flexibility and much better service, without significant capital investment. Companies that focus on transportation cost drivers gain on two fronts: they can control cost overruns or reduce current costs, and they can improve customer service and satisfaction by tailoring services, such as lead times and delivery frequencies, to customer needs.

Warehousing

Understanding the baseline

The first challenge in optimizing warehouse operations is that there is no "standard" — they tend to be as diverse as the products they store. A multi-client facility, for example, with a huge number of SKUs and diverse inventory turnover, looks vastly different from a small-volume operation with a few SKUs. As a consequence, it has been difficult to identify best practices or apply them across a broad variety of settings. Warehouse managers struggle with special circumstances as they try to improve lackluster performance.

We have developed a comprehensive approach to performance measurement across all types of warehouse, providing supply chain managers with a tool to rate warehouse efficiency. We begin by calculating the clean-sheet cost, space and capital that an "ideal" warehouse would need to handle the given volume. We then adjust for site-specific circumstances, such as multiple floors and high labor costs. We add logistic service provider margins if the warehouse is outsourced. The results reveal the warehouse's theoretical and realistic performance gaps.

A wide gap

We have used the model to evaluate more than 40 diverse facilities worldwide. Most are operating 20 to 50 percent less efficiently than the clean-sheet reference. In one European warehouse, our clean-sheet model showed a performance gap of more than 50 percent.

The gap arose not because the warehouse lacked technology or suffered from the structural disadvantages of the goods it handles. Instead, we found that it is the cumulative effect of dozens of slightly sub-optimal processes and the lack of lean mindset. A few fundamental changes in the way these facilities are organized and managed could immediately close at least half of the gap between current performance and the benchmark.

Some warehouses simply suffer from lack of attention. Designed for one purpose a decade ago, their managers make only minor modifications to cope with dramatic business changes such as increasing product and delivery complexity, a merger or acquisition, or new technologies or supply chain structures.

Some solutions intended to improve performance often have exactly the opposite effect. Technology-heavy approaches, such as automated storage areas, sorting technology or classical transaction-based ERP systems, have a strong tendency to reduce flexibility, particularly short-notice flexibility, which is exactly what many modern supply chains demand. The payback on such systems is poor, with the capital cost being many multiples of the savings achieved by reducing relatively low-cost labor.

Outsourcing is a common practice in pharma, but it often fails to remedy bad warehouse practice. Managers may be tempted to outsource their operations to leverage factor cost advantages, for example, but outsourcing inefficient processes simply offers service providers higher margins. And since warehouse inefficiencies can arise externally, such as volatile demand patterns or undisciplined ordering, providers are often unable to create real cost advantage.

…Easy to bridge

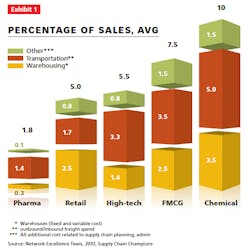

At the heart of transforming warehouse operations is the rigorous and relentless application of lean and six sigma techniques to eliminate sources of waste, variability and inflexibility. Most are simple, pragmatic activities that require little or no financial investment — they rest on six building blocks of performance: processes, people, performance management, third parties interaction, layout and ownership (see Exhibit 2). The examples below are typical of projects worldwide.

Better processes. The same sources of waste that the lean approach seeks to eliminate in the manufacturing context, such as unnecessary motion or double-handling, account for many unnecessary warehousing costs and introduce critical inflexibility. A tendency to stick with established processes and resist change also drives down efficiency.

For many orders, picking and packing processes can be combined, reducing handling steps, motion, transportation and space requirements.

Receiving processes often include labor-intensive breakdown of pallets, which is rarely well-organized or coordinated. By optimizing the sequence of actions for pallet breakdown and organizing workplaces to make the process easier, effort can be cut by half.

Pickers in one facility were spending two minutes between picks waiting for new lists to be printed. By introducing an automated system that produced a new list each time one was taken, pickers could always expect their next pick list to be available.

In one pharma warehouse, the pickers had to put labels on all products delivered to hospitals. That required retrieving the products, putting a label on each package and putting it back in its original location. By attaching the label beforehand, this step could be completely eliminated, saving 50 percent of the pallet picking time.

Documentation and standardization are hugely powerful in process improvement. Once managers have identified and developed best practices, clear standard operating procedures help ensure that all staff uses optimized processes.

Trained people. Workload requirements in warehouse facilities can vary by as much as 50 percent day to day. Around half of this variation can be predicted in many facilities based on historical data, but conventional approaches to workforce flexibility simply cannot respond to these rapid changes in demand. As a result, facilities are often substantially overstaffed to guarantee performance.

By reducing the notice period for shift schedules to one or two days, facilities can more closely match on-site staffing to demand, raising efficiency by up to 15 percent. Some facilities have achieved even better results using a super-flex temporary workforce, often students. They can respond to SMS messages with only a few hours' notice, allowing the facility to respond on the same day to unexpected demand peaks.

Given warehouse workers' relatively low skills and high turnover, many employers minimize recruitment and training investment to keep costs down. In our experience, however, improved training can boost productivity by 5 to 10 percent. Training must be regular and continuous and focus on specific aspects of each employee's performance.

Some facilities have dramatically reduced staff turnover through straightforward refinements to their recruitment processes, such as aptitude tests on the shop floor. Applicants pick for one hour under observation. Those that do not show signs of significant performance improvement during that hour are not hired.

Performance management. Most modern warehouses collect detailed data on the performance of individual employees automatically as part of standard management systems. Unfortunately, few exploit this data effectively to motivate and improve employee performance. Just demonstrating ongoing performance in a clear, accessible way can deliver immediate improvements. A notice board showing the relative performance of pick teams, for example, can create competition and drive performance.

High-performing facilities supplement visible performance metrics with daily discussion of historical performance and upcoming expectations. A five-minute discussion at the beginning of each shift reinforces the importance of good performance.

The biggest productivity improvements — of as much as 20 percent — come from linking pay to performance. Such systems must be set up with care to ensure that they reward quality as well as speed. Some facilities reinforce the impact of performance-related pay with near real-time feedback, using pick-by-voice technology, for example, to let staff know how well they are doing.

Measuring and rewarding the "softer" aspects of performance can deliver powerful long-term benefits, too. A visible, rewarded, "employee of the month" scheme, for example, can have a positive impact on staff satisfaction.

Interaction with third parties. Warehouses are not islands. To operate efficiently, a facility must interact effectively with three main external groups: upstream with suppliers, downstream with internal and external customers, and sideways with the wider organization. But not every warehouse operating model is designed to reflect the service requirements of internal or external customers. Warehouses are often unable to flex their operations in response to predictable fluctuations in customer demand, leaving them overstaffed or underperforming.

Improving supplier relationships can be straightforward. Bad delivery accuracy can lead to congestion in the receiving area during peak times, for example. By assigning time-windows for delivery and clear consequences for missing the window (not receiving the truck, for example), volume flow can be leveled and the workforce utilized better.

Working with suppliers can also ensure that goods arrive in the right order and in the right form of packaging for direct storage, reducing labor required to receive goods.

While it is not always possible to dictate delivery schedules or strategies to customers, leading facilities are beginning to exploit cooperative working methods to develop mutually beneficial least-cost approaches. Improved delivery performance and high customer confidence help to build the trust essential for this kind of activity. On this platform, some facilities are introducing variable pricing and service levels to encourage customers to order at the most cost-effective quantities and delivery frequencies, with higher levels of service available for a price premium.

Improved flexibility. Many facilities opt for a "one size fits all" approach to layout, rather than segmenting assets according to product types and customer requirements. Many managers are also unwilling to alter facility layouts as demand patterns change, eroding performance over time. A pharma warehouse was able to reduce process time by 20 percent simply by eliminating picking from the highest shelves. Sometimes this problem is compounded by investments in costly and highly inflexible automation equipment.

Replacing fixed equipment with flexible, reconfigurable systems can have big benefits, while the penalties of inflexibility can be severe. One retailer made big investments in automating a warehouse before changes in business needs created spare capacity. The retailer tried to resell this capacity to third parties, but its system was so inflexible that it was unable to fulfill the requirements of any of the interested organizations.

A common way to benefit from flexibility is to reorganize the facility layout to position items according to pick frequency. By placing fast and super-fast moving items right by the loading dock, walking distances and pick times can be reduced dramatically. Such implementations must be carried out with care, however. To avoid congestion at the pick face it is useful to mix the fastest-moving items with some slower movers.

Ownership impact. The outsourcing of warehouses to third-party operators is a common strategy for companies that do not consider warehousing to be a core competence. But many such deals simply transfer inefficient processes to a new owner, while cost-plus contract terms seldom create an imperative for improvement on the part of the service provider. Outsourced warehouses are viewed as black boxes, leaving major opportunities for collaboration between suppliers, plants and customers on the table. Moreover, companies that have developed their own lean manufacturing system miss the opportunity to apply their expertise to these outsourced warehouse operations.

Change of ownership usually falls outside the scope of an improvement project. But this optimization approach can be applied just as well by a warehouse operator, creating competitive advantage from its ability to operate at lower cost and at higher flexibility.

Transportation

Understanding the baseline

While pharmaceutical companies can save as much in transportation as they can in warehouse operations, delivering those savings requires a different approach. If companies have historically ignored their warehouse operations, at least they began with a good idea of the size and location of their facilities. Transportation costs, by contrast, come from many hundreds of thousands of widely distributed individual operations every year.

Complexity is what makes transportation difficult to improve. Many pharmaceutical companies have tremendous variability in their transport operations, with different customers demanding different service levels and a multitude of transport providers delivering services in different ways. Companies can cut through this complexity, however. By building a full picture of their transportation operations, they can see, often for the first time, exactly where to find the primary drivers of transportation cost. Armed with this information, they can identify and exploit opportunities and save up to 20 or even 30 percent of transportation costs.

One large pharma player began optimizing transportation by analyzing historical transport data for a full year. It collected information and analyzed each delivery (e.g., shipment types, sizes, modes of transport, provider, customer, region, type of service and cost) to understand the real drivers of transportation costs. The analysis revealed three critical service categories that had a disproportionate effect on transportation costs:

- Temperature-controlled distribution. While 98 percent of product by weight passed through the firm's ambient distribution chain, the 2 percent that had to be shipped in refrigerated vehicles accounted for a quarter of all shipments — and nearly half total transportation costs.

- Special delivery services. Express shipping guaranteed by 10 a.m. the next day can cost two to five times more than conventional 24-hour delivery. These special deliveries represented only 1 percent of the shipments, but accounted for most of the excess cost.

- Shipment size. The vast majority of shipments weighed less than five kilos, but these small shipments cost the company around six times as much per kilogram as larger shipments. Even where the company did manage to consolidate deliveries into larger shipments, it usually failed to capture all the available savings; by weight, a quarter of product was shipped in the lowest cost bracket, but nearly half fell into the next price bracket up.

Opportunities for action

Once they understand their cost drivers, companies can embark on a systematic approach to reduce transportation costs. They can look broadly at four main levers. First, they can check compliance with freight contracts and minimize surcharges. They can challenge the rates provided by the freight forwarders. They can improve contract terms and conditions to share risks and benefits with their freight forwarding partners. And finally, companies can do much to understand customer breakpoints and incentivize customers to choose cost-effective options.

Compliance auditing. A simple auditing of monthly invoices will reveal the surcharges a company is paying due to special terms. It can check contract compliance by modeling the expected cost of shipments under the contract terms, and compare these with the actual bills from service providers.

For example, some companies find that they are paying significant fuel surcharges or charges for waiting time or late payments. Where these charges are large, they can improve practices to minimize them ó by ensuring vehicles are loaded rapidly on arrival at distribution centers, for example.

Rates improvement. A comparison of freight tariffs offered by suppliers on similar routes will provide an independent benchmark. Some companies go even further, using clean-sheet cost-modeling to provide bottom-up estimates of a freight forwarder's cost of operation, fixed costs and profit.

Clean-sheet models use the best available combination of vehicle, fuel, labor and other running costs to calculate the lowest possible cost of providing an agreed service level. This cost is then used as a starting point in discussions with service providers. When pharma companies understand the causes of inefficiency in their suppliers' operations, they can challenge them to provide better tariffs. In the case of the company described above, clean-sheet cost modeling indicated significant savings potential even after accounting for inefficiencies like partial utilization of trucks and the supplier's failure to use its vehicles for back-haul operations.

Improving contract terms. The volatility of fuel prices has increased interest in contract terms that share risks and rewards. High fuel costs were painful for many logistics service providers. To protect themselves against further losses, many have increased their prices or introduced fuel surcharges. While fixed prices work in favor of pharma companies when fuel costs are high and rising, they create unnecessarily high bills when oil is cheaper.

A more effective approach for both parties is agreement that includes a variable portion of total cost associated with the fuel index. Such terms can do much to bring transportation costs closer to the true cost of delivering services.

Understanding customer breakpoints. By changing the way they run their internal processes and incentivizing customers to select more cost-effective delivery options, pharma companies can cut costs and improve asset utilization.

Many outbound pharma supply chains operate at high service levels. For example, wholesalers may receive deliveries every day of the week or every two days. Working with wholesalers to reduce delivery frequencies to twice per week, for example, could cut transportation costs significantly.

End customers enjoy high service levels, too, with pharmacies and hospitals receiving off-hours or short-notice shipments, often at no extra cost. By eliminating high-cost delivery options, or introducing a nominal surcharge for urgent deliveries, even one that doesn't cover the full costs, companies can help change consumer behavior.

Logistics and distribution operations deserve more attention from pharmaceutical companies. They account for a significant share of overall supply chain cost, and optimized logistics performance can greatly improve the customer's experience of the supply chain.

The ability to deliver the products customers want, when they want them, in cost-effective ways could move logistics from expensive overhead to significant competitive differentiator. And achieving this kind of change does not require major capital investments or long lead times. With careful management of design, processes and personnel, most organizations could achieve double-digit performance improvements — quickly and sustainably.