Recently, a number of different trends have converged to demand a new type of biopharmaceutical facility, one that emphasizes flexibility and agility. Drawing this new blueprint are:

- business needs to minimize timelines and financial risks;

- “biotech on demand,” and the ability to shore up local manufacturing capacity, quickly, to meet market needs;

- national security needs for systems that can easily and rapidly respond to biological attacks;

- urgent national health needs to protect the public from large-scale, fast moving epidemics and pandemics.

Today’s biopharmaceutical manufacturing facilities are smaller and more flexible, efficient and cost-effective than those of the 1990’s, and they are able to adapt quickly to market changes. The goal isn’t technology in and of itself, but greater product and process knowhow for speed to market. With modular systems, we can now place an entire small-scale clinical production line inside an 18’ x 42’ x 13’ (W x L x H) environment.

Based on defense and health department standards, vaccine manufacturing facilities have been blazing new trails. Traditionally, it has taken between 14 and 20 years to move from pathogen identification to vaccine safety and efficacy trials. The new goal, set by the U.S. Defense Department’s DARPA (Defense Advanced Research Projects Agency), and repeated in specs set by BARDA, is to cover the same ground in less than 22 weeks.

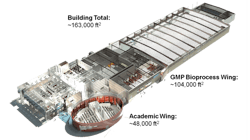

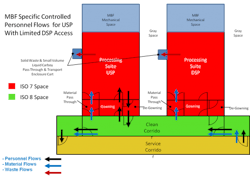

The lifeblood of this flexible, multiproduct and multitechnology future will be the Mobile Bioprocessing Unit (MBU), which has already been built for manufacturing small, clinical-scale quantities of some therapies. (Figures 1-4 illustrate the National Center for Therapeutics Manufacturing, housed at Texas A&M University in College Station, Texas.) The key feature of these mobile units is that they are self-contained, with inherent air handling and other critical equipment and controls built in and standard.

Figure 1. National Center for Therapeutics Manufacturing, designed and built based on Flexible Manufacturing Criteria

Each MBU is used for a single, biologically distinct technology (bacteria, mammalian cells, plants, etc.), thereby eliminating any cross-contamination issues with regulatory agencies. When they are not being used, MBUs are designed to be moved to cleaning and refurbishing areas, and ready to connect when needed. The goal is to:

- Enable low-cost, rapid production of proteins/products, all of which are correctly folded and biologically active, as well as cGMP-qualified master virus banks and cell lines;

- Draw on extensive clinical use and regulatory history;

- Scale MBU’s to large volumes and high cell densities;

- Feature FDA-qualified cell lines and virus banks;

- Produce cGMP clinical materials affordably and to provide manufacturing and treatment capacity on a moment’s notice.

Business realities, combined with demographic and market forces, will accentuate the national imperative for flexible and more cost-effective manufacturing. Compared with other biopharmaceutical products, monoclonal antibodies are large proteins that require relatively high doses—and traditionally necessitate high-volume manufacturing process equipments/systems and facilities. Many biopharmaceutical facilities are still designed as traditional fixed equipment/systems and facilities, with fixed piping and vessel layout and large bioreactor volumes. Such facilities require a significant financial investment along with high total installation costs.

Recent increases in cell culture yields/titer have led to significantly reduced bioreactor volume requirements, which again have opened the door for single-use manufacturing technologies such as pre-sterilized assemblies of single-use bags, tubing and filters that are only used once and then disposed of. With a financial investment reduction and simplified installation, single-use technology could be more appealing than other fixed technologies.

Combining single-use technology and high-yield processes could further reduce the price tag for comparable facilities by 50 percent. This combination is being pursued in a number of biopharmaceutical facilities today—the full effect is truly a paradigm shift.

Additionally, single-use technology runs a much lower risk of batch-to-batch contamination, which is of particular importance in multipurpose facilities. A facility based on single-use technology is easy to reconfigure and can therefore be ready for a new product in a matter of days. This flexibility translates to reduced development timelines and thus accelerated time-to-market peak.

In an increasingly fractionated market, the need for speed to secure market shares is more important than initial minimal cost of manufacturing. And with remarkably increased cell titer, the cost contribution from the manufacturing facility is limited compared with development costs.

Figure 4. A downstream processing suite developed as part of Project GreenVAX at NCTM. GreenVAX uses tobacco rather than egg-based vaccine technology.

The need for local biopharma manufacturing capacity is increasing in the fast-growing emerging markets as the customer base expands and national initiatives manage the markets. The trend is being amplified by blockbuster patent expiry and the implementation of regulatory legislation for accelerated pathways for biosimilars. For biopharmaceuticals, emerging markets are not about low-cost manufacturing hubs, but about being on location to get access to the local market. Consequently, many big pharmaceutical companies as well as local manufacturers are investing in new facilities in these countries. A blueprint facility concept that can be established as interesting markets develop will become an important strategic asset for biopharmaceutical players with global aspirations.

In reality, the important issue is not stainless steel or single-use technology, but rather how technologies could be combined to provide the most productive and cost-effective process in a fast and predictable way. Choosing one or the other technology concept or a hybrid of the two depends on both strategic considerations and feasibility studies of each individual case.

Clearly, biopharmaceutical manufacturing’s paradigm is changing from stainless steel to hybrid combinations of single-use and stainless steel, and complete single-use facilities. Manufacturers are already exploring opportunities, aggressively, and we can expect this trend to continue.