Critical Parameters of Managing Contract Risks

In November 2010, PharmaManufacturing.com hosted a webinar on “Minimizing Risks in Contract Partnerships,” with an eye towards how drug sponsors can use current principles of risk management (as spelled out in ICH and other regulatory documents) to strengthen contract manufacturing partnerships. Speakers included consultant Russ Somma of SommaTech LLC, Richard Poska, director of global pharmaceutical regulatory affairs with Abbott, and Franco Pasquale, senior manager for Roche/Genentech’s contract manufacturing operating unit. (The on-demand program is available here.)

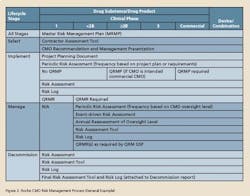

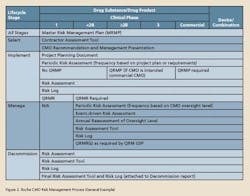

Somma set the stage with a theoretical look at how ICH Q8, Q9, and Q10 guidelines should serve as the foundation for contract partnerships. “Any contract effort has to be grounded in the ICH guidelines,” he said. “The development aspects needed to support a regulatory submission are very similar to those which are key to forming a sound relationship with partners.” Somma calls it a “knowledge approach” to outsourcing, as shown in Figure 1 (whose origins he credits to FDA’s Moheb Nasr).Abbott

Abbott’s Poska spoke on “Regulatory CMC Risk Assessment Between Contract Partners,” sharing key elements and best practices of Abbott’s work with its long-term contract partners. Initial considerations for any partnership must be based upon compatibility, he began. Do contract partners share the same general corporate philosophies, whether for product development or commercial manufacture? On this point, Poska said proper due diligence is critical.

An approved and shared understanding of the target product profile is another fundamental aspect of forging a partnership, and can be used as a “contract” in terms of expectations for a product’s performance, and “forms a basis for control strategy and specifications.”

Potential partners, Poska noted, must also have a very clear understanding of the documentation challenges that lie ahead, whether for investigational or commercial product applications: “How much information of the knowledge and design space that’s been included in the regulatory filing has been shared with your contract house? If they’re the ones that are going to be doing the troubleshooting, that’s pretty critical information to know what’s been investigated, to help them solve problems much quicker, within the confines of your regulatory filing.”

Documentation must also be considered from a more practical, system compatibility standpoint, he noted. Does the contract partner share the same platforms? Is there a reluctance on the sponsor’s part to share IT platforms? Questions such as these can make or break partnerships and projects, and are important to consider at the very beginning of contract discussions, Poska said.

Poska, too, focused on the ICH documents and how all parties must understand them and recognize their importance. “Does everybody speak the same ‘language’ and have the same expectations?” In other words, he said, does everyone involved in a partnership have the same understanding of control strategies, CQA, CPP, CPC, Design Space, DOE, and PAT.

There is an “alphabet soup” of terms and phrases, he noted, and it’s absolutely necessary to make sure that partners have the same understanding of these terms. “And the other thing is, how do you know?” he asked. “You have to be able to somehow verify that you and someone you’ll be working with speak the same language.”

Finally, Poska reiterated Somma’s point about partners having a mutual understanding of criticality. “We talk about critical being a function of risk,” he said. “It’s very important to have a shared understanding of criticality and the assumption of risk, and have an agreed upon risk tolerance between your company and the contract house. That can’t be overemphasized.”