Last month, BIOCOM and PriceWaterhouseCoopers released “Improving America’s Health IV,” the latest in a series of surveys that focus on FDA’s relationship with life sciences companies. This survey received considerable input from FDA officials and directors of the Centers for Biologics, Drug Evaluation and Research, and Devices and Radiological Health, who helped design questions to gain insights into particular issues that come up with drug companies during reviews.

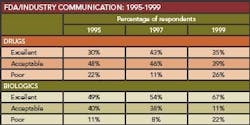

The first few surveys, in 1995, 1997 and 1999, were designed primarily to be a “report card” for FDA. Version III of the survey, published seven years ago, highlighted problems to be addressed, such as poor communication, lack of FDA reviewer knowledge and review times.

The latest version goes beyond assessing FDA to see how effectively the industry is using FDA guidance and resources, to identify ways to improve the efficiency of new product submissions without compromising patient safety.

“We want this survey to become a working document, and hope that the next one will not only reflect work in progress but also improvements, and the results of what has been achieved,” says BIOCOM CEO and President Joe Panetta. BIOCOM had been involved in the survey since 1995, but has taken a leadership role starting with Version IV.

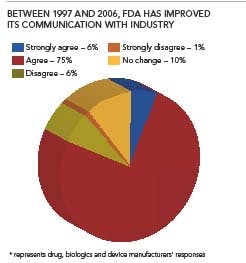

Despite its extensive promotion at BIO 2006 and among BIOCOM’s more than 550 member companies, only 67 pharmaceutical, biopharmaceutical and medical device companies took part in the survey this year. Nevertheless, results indicate clear trends, and show that communication and the working relationship between FDA and industry have come a long way since the FDA Modernization Act of 1997.

They also show that factors such as FDA staff turnover have affected review times and interactions between industry and Agency reviewers, suggesting the need for improved funding. “Politicians need to understand the importance of having a strong and well-funded FDA,” Panetta says. “When user fees were introduced, they were intended to be an adjunct to government funding, but they are now funding more than half the Agency’s efforts.”

Broadly, results suggest that overall relations have improved, and 81% of all respondents noted “significant improvements” since the FDA Modernization Act was passed in 1997.

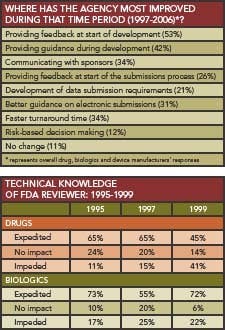

Between 2000 and 2006, FDA has made the most progress in providing feedback and guidance, respondents believe. Turnaround times and risk-based decision-making were areas where respondents felt the Agency had made the least improvement.

However, a communications gap now exists, in which pharmaceutical and biopharmaceutical companies lack understanding of the regulatory process and FDA lacks understanding of the science itself, suggests Panetta.

This year’s survey results suggest that many drug companies aren’t proactive in communicating with FDA at the very start of the drug review process. Only about half of this year’s respondents said they contacted the Agency early in the development process, and that they sustained that communication.

“The issue of guidance is critical,” says Panetta. “Results show that we need to understand the importance of communicating regularly with FDA, to follow guidances and question them actively to ensure that they have been properly understood.”

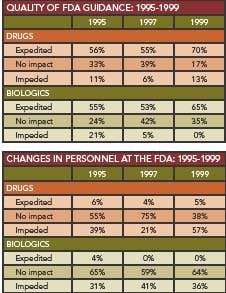

Some complaints – for example, about review time – have persisted from the past (Box, right). However, respondents said that FDA guidance has had a positive impact on the overall development process, with 73% saying that it has given them a better understanding of requirements and 13% saying that it has expedited development.

While drug reviewers’ expertise was cited as problematic in some past surveys (Box, p. 11), 60% of this year’s respondents described their Agency contact as extremely knowledgeable and responsive, although 43% found it necessary to “escalate the request above the original level of discussion” to obtain a response.

Issues of FDA staffing and consistency of guidance came up this year, with 31% of drug manufacturers and 46% of biologics manufacturers sayng that FDA changed its position during the review of a new product.

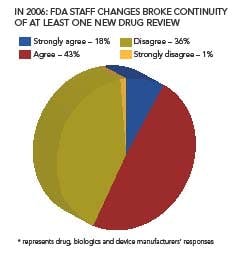

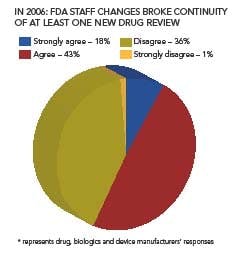

Staff turnover was another factor that impeded drug development efficiency; 43% of respondents this year say that FDA personnel changes resulted in a break of continuity in at least one of its drug reviews.

Despite controversy over digital signature requirements spelled out in 21 CFR Part 11, half of all respondents and 68% of drug company respondents said that the Agency’s guidance on data standards has helped them better automate internal processes.

Respondents also praised ICH guidelines, with 66% reporting that ICH guidelines have had a positive impact on development; among drug companies that figure is 78%; for biologics companies, it is 69%.

Respondents this year also had good things to say about FDA’s Critical Path Initiative, with 68% saying that the Initiative is on the right track. However, only 41% of respondents believe the program is focusing on the right issues.

Respondents were unanimous about the need for greater post-approval drug safety. Over 80% of respondents agree that pharmacovigilance is a key issue facing the industry, with most agreeing that a universal adverse-event database would improve patient safety as well as the analysis of safety data.